Cost Segregation Study Template

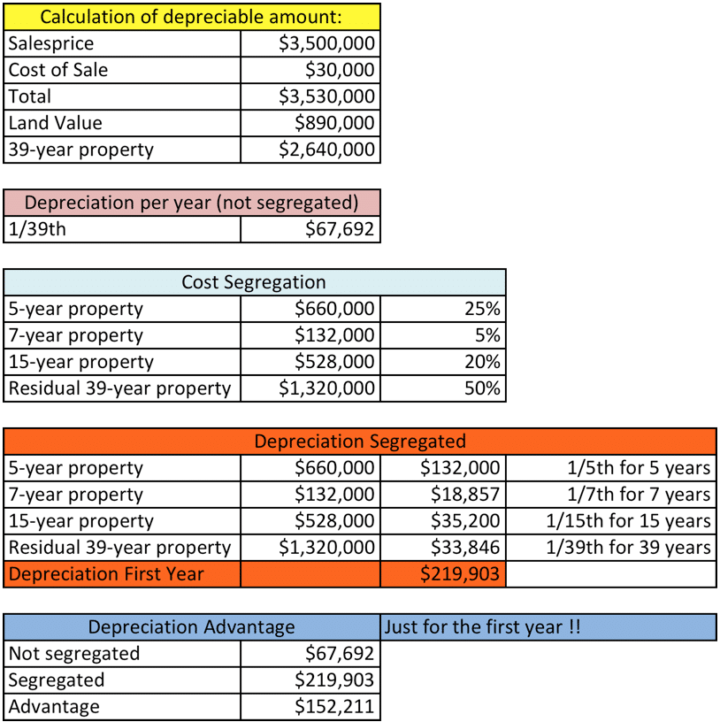

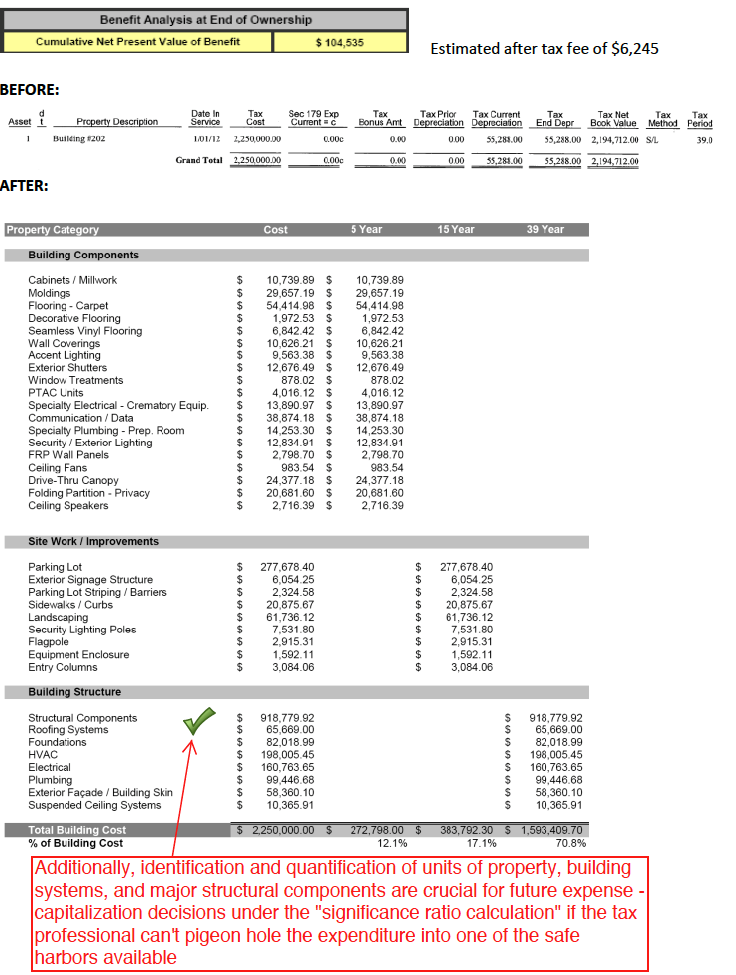

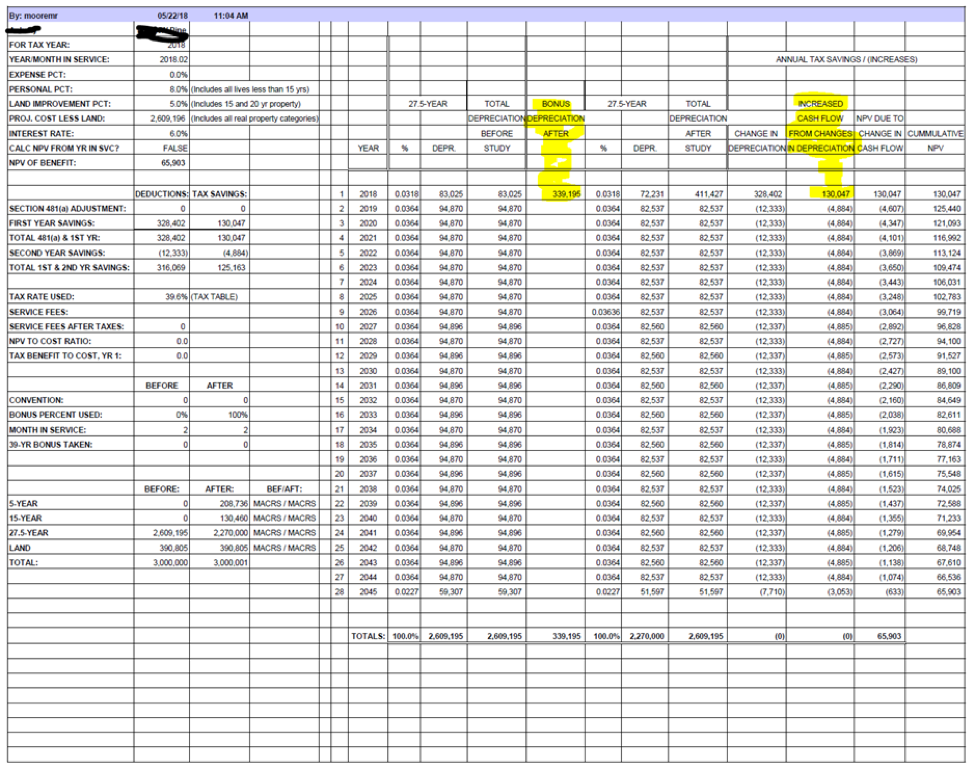

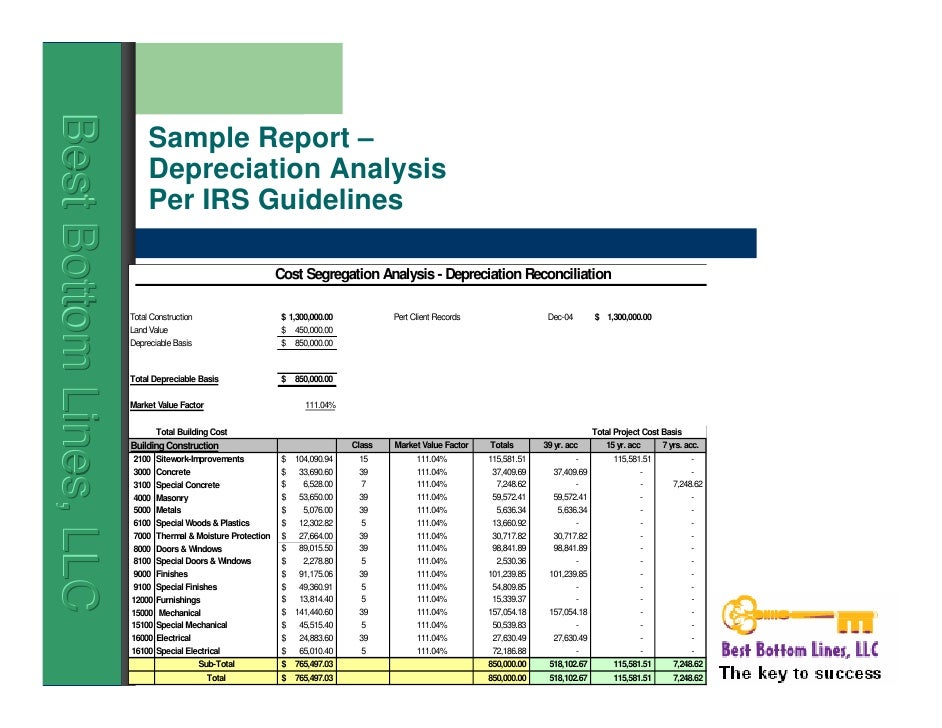

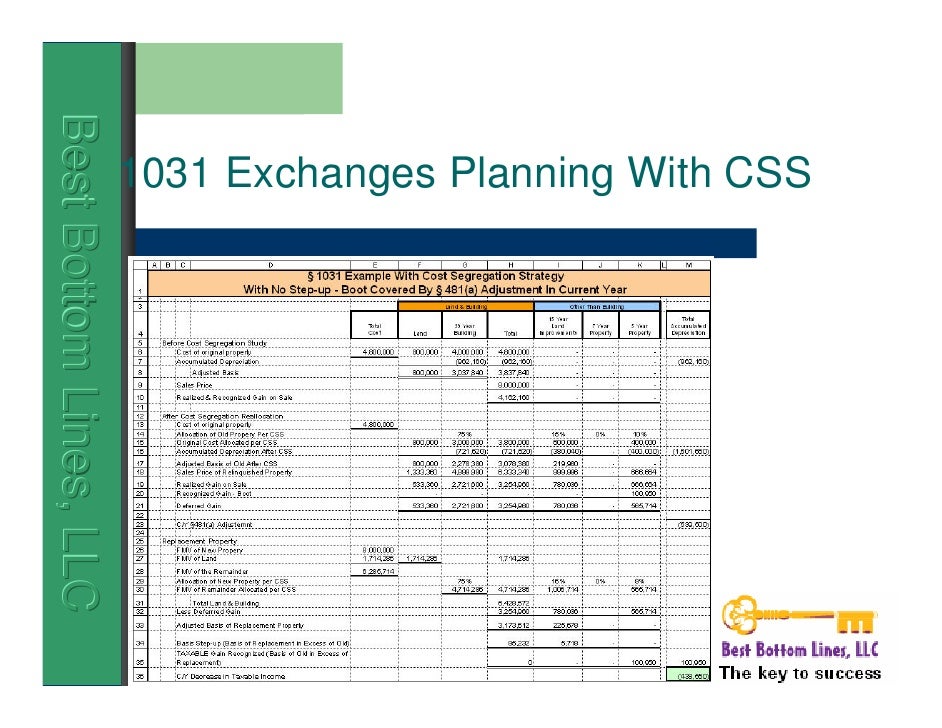

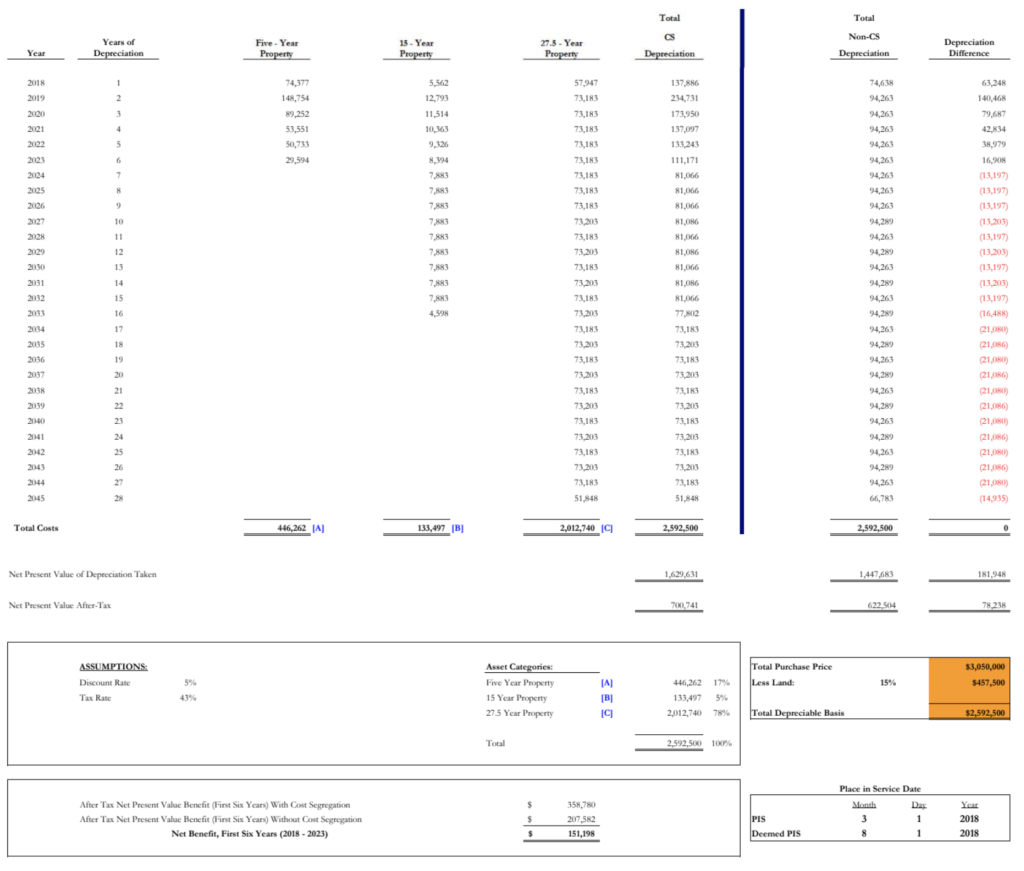

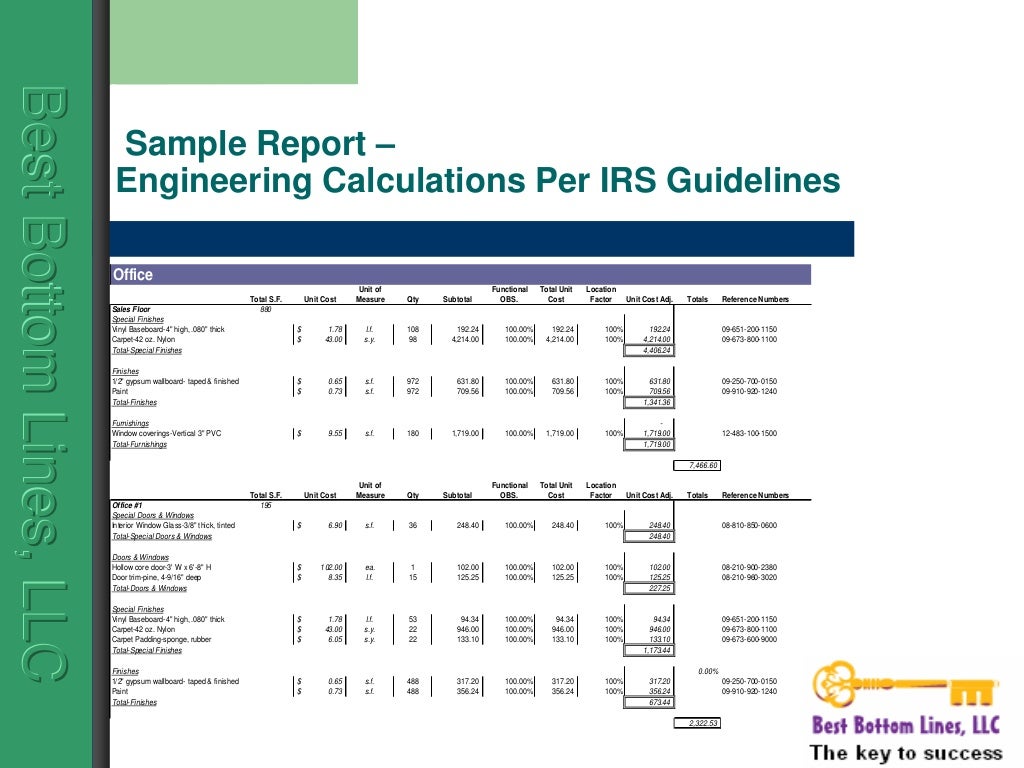

Cost Segregation Study Template - Web cost segregation studies, like other tax records, are subject to irs review. Web i am planning to perform a cost segregation study on the str 's i have purchased to take advantage of the bonus depreciation rules. Buildings constructed or acquired in prior years. Web a cost segregation study is a process that looks at each element of a property, splits them into different. Web newly constructed or acquired buildings. The content of this white paper is aimed at owners of. Web a cost segregation study dissects the construction cost or purchase price of the property that would otherwise be. This process accelerated $392,321 of depreciation deductions for the client. Web cost segregation studies are performed for federal income tax purposes; Web below we provide example cost segregation analyses for various property types. Web engineers to conduct a cost segregation study of the buildings at 123 davis drive in st. Web a cost segregation study is a process that looks at each element of a property, splits them into different. Web updated cost segregation audit guide details the irs’ expectations. Buildings constructed or acquired in prior years. To meet the irs’ expectations, a. Web below are cost segregation examples (a.k.a. Web cost segregation studies free up capital by accelerating the depreciation of § 1245 tangible personal property, land. Web i am planning to perform a cost segregation study on the str 's i have purchased to take advantage of the bonus depreciation rules. Web a cost segregation study identifies personal property assets that. Each type of property will have a different projected tax savings based on. This process accelerated $392,321 of depreciation deductions for the client. Web a cost segregation study dissects the construction cost or purchase price of the property that would otherwise be. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation.. Web newly constructed or acquired buildings. Web a cost segregation study is a process that looks at each element of a property, splits them into different. Web cost segregation studies, like other tax records, are subject to irs review. Web engineers to conduct a cost segregation study of the buildings at 123 davis drive in st. Web cost segregation studies. Web below we provide example cost segregation analyses for various property types. The content of this white paper is aimed at owners of. Web i am planning to perform a cost segregation study on the str 's i have purchased to take advantage of the bonus depreciation rules. A mini case study), from projects we have conducted for real estate.. Buildings constructed or acquired in prior years. Web a cost segregation study enables clients to maximize federal tax depreciation benefits under the modified. Your resource to discover and connect with designers worldwide. Web discover 17 cost segregation study designs on dribbble. Web the key to taking advantage of cost segregation is to first order a cost segregation study. Web newly constructed or acquired buildings. Web a cost segregation study is a process that looks at each element of a property, splits them into different. Web cost segregation studies, like other tax records, are subject to irs review. Buildings constructed or acquired in prior years. However, one of the main purposes of. Web a cost segregation study enables clients to maximize federal tax depreciation benefits under the modified. Web cost segregation studies are performed for federal income tax purposes; Web cost segregation studies, like other tax records, are subject to irs review. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation. Web discover. Note that the property is. Web a better understanding of cost segregation studies (css) and its benefits. Web below we provide example cost segregation analyses for various property types. Web brian lefever vp of operations, titan engineering published may 3, 2019 + follow cost segregation can be done on. Web cost segregation studies, like other tax records, are subject to. Web i am planning to perform a cost segregation study on the str 's i have purchased to take advantage of the bonus depreciation rules. Web newly constructed or acquired buildings. To meet the irs’ expectations, a taxpayer needs to submit. Buildings constructed or acquired in prior years. Web engineers to conduct a cost segregation study of the buildings at. Web cost segregation studies free up capital by accelerating the depreciation of § 1245 tangible personal property, land. Web a better understanding of cost segregation studies (css) and its benefits. A mini case study), from projects we have conducted for real estate. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation. Web below we provide example cost segregation analyses for various property types. Web i am planning to perform a cost segregation study on the str 's i have purchased to take advantage of the bonus depreciation rules. Web a cost segregation study enables clients to maximize federal tax depreciation benefits under the modified. Your resource to discover and connect with designers worldwide. This process accelerated $392,321 of depreciation deductions for the client. Web cost segregation studies are performed for federal income tax purposes; Web cost segregation studies, like other tax records, are subject to irs review. Web engineers to conduct a cost segregation study of the buildings at 123 davis drive in st. • how cost segregation studies are prepared; Web the key to taking advantage of cost segregation is to first order a cost segregation study. To meet the irs’ expectations, a taxpayer needs to submit. The content of this white paper is aimed at owners of. Each type of property will have a different projected tax savings based on. However, one of the main purposes of. Web updated cost segregation audit guide details the irs’ expectations. Web discover 17 cost segregation study designs on dribbble.Cost Segregation Analysis Seals the Deal Staebler Real Estate

The Cost Segregation Study Understanding Your Estimate of Benefits

How Much Does A Cost Segregation Study Cost Study Poster

Cost Segregation & Bonus Depreciation Simple Passive Cashflow

Cost Segregation Study

Cost Segregation Study

Cost Segregation & Bonus Depreciation Simple Passive Cashflow

Costsegregationstudy Advanced Tax Advisors

Cost Segregation Explained CostControlTeam

Cost Segregation Study

Related Post: