Cost Segregation Template

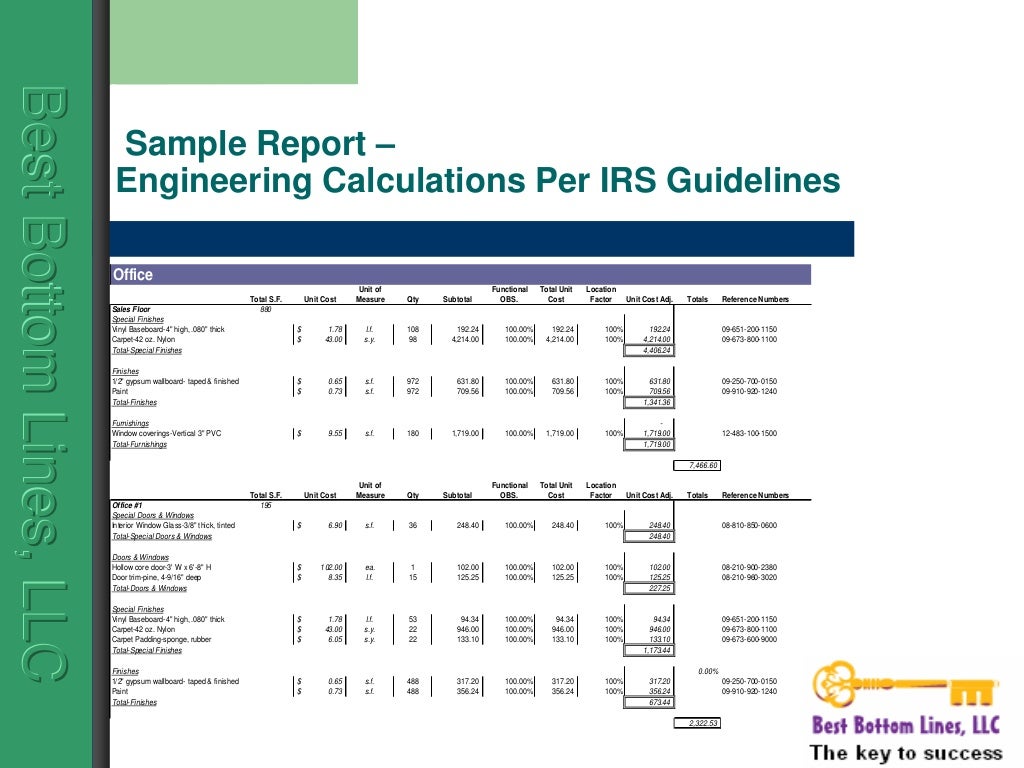

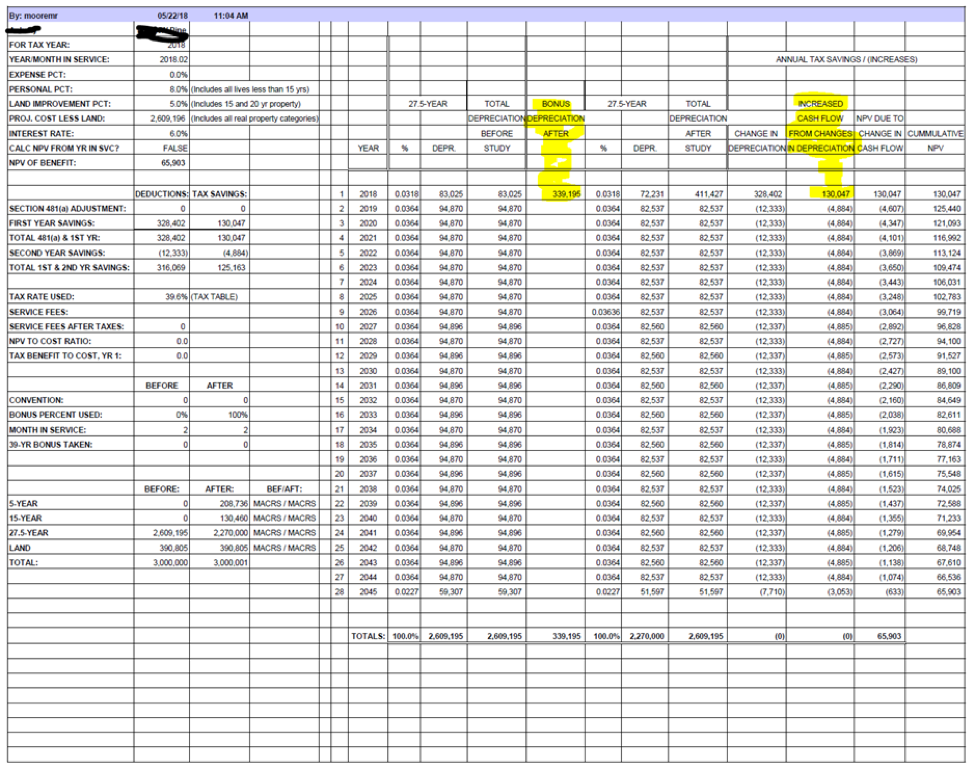

Cost Segregation Template - Web cost segregation studies, like other tax records, are subject to irs review. Web cost segregation is a tax planning tool that gives real estate investors the chance to accelerate the depreciation. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation. $ (must be over $100,000) land allocation *: Please fill out the form below with your property’s information, and you will be on. Web cost segregation preliminary analysis. Web cost segregation requires assigning the “proper recovery period” to each asset. Web a brief history under prior law taxpayers would separate a building’s parts into its various components—doors, walls and floors. This process accelerated $392,321 of depreciation deductions for the client. Note that the property is. A commercial or residential building may. Web cost segregation made simple cost segregation is arguably the most powerful tax saving tool available to real estate. Web a cost segregation study is a process that looks at each element of a property, splits them into different. Web it was after that 1954 decision outlawing public school segregation that the u.s. Web. Web cost segregation studies, like other tax records, are subject to irs review. Web cost segregation preliminary analysis. Web engineers to conduct a cost segregation study of the buildings at 123 davis drive in st. Web get this template here: Web the cost segregation savings calculator estimates your federal income tax savings and provides: Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation. A commercial or residential building may. Web a brief history under prior law taxpayers would separate a building’s parts into its various components—doors, walls and floors. Estimated allocation to 5, 7,. Web engineers to conduct a cost segregation study of the buildings. Web a brief history under prior law taxpayers would separate a building’s parts into its various components—doors, walls and floors. Web how to use the cost segregation calculator: Web cost segregation requires assigning the “proper recovery period” to each asset. Saw a boom in the number of religious. Web to meet the irs’ expectations, a taxpayer needs to submit a. Saw a boom in the number of religious. • how cost segregation studies are prepared; Web cost segregation made simple cost segregation is arguably the most powerful tax saving tool available to real estate. However, one of the main purposes of. $ (must be over $100,000) land allocation *: Web cost segregation is a tax planning tool that gives real estate investors the chance to accelerate the depreciation. However, one of the main purposes of. Web cost segregation made simple cost segregation is arguably the most powerful tax saving tool available to real estate. Web get this template here: Web the source advisors cost segregation engineers were engaged to. Web to meet the irs’ expectations, a taxpayer needs to submit a “quality cost segregation report” supported by a “quality cost segregation. Web a cost segregation study is a process that looks at each element of a property, splits them into different. To use the calculator, choose a property type/use (residential or. Web cost segregation studies, like other tax records,. Web to meet the irs’ expectations, a taxpayer needs to submit a “quality cost segregation report” supported by a “quality cost segregation. Web cost segregation preliminary analysis. Web cost segregation is a tax planning tool that gives real estate investors the chance to accelerate the depreciation. Web the cost segregation savings calculator estimates your federal income tax savings and provides:. Karen chenaille poster pro real estate agent sevierville,. Web cost segregation made simple cost segregation is arguably the most powerful tax saving tool available to real estate. Web cost segregation preliminary analysis. Web cost segregation requires assigning the “proper recovery period” to each asset. Web to meet the irs’ expectations, a taxpayer needs to submit a “quality cost segregation report”. Web diy cost segregation study tips/tools/templates? $ (must be over $100,000) land allocation *: Web a brief history under prior law taxpayers would separate a building’s parts into its various components—doors, walls and floors. Web get this template here: Web the cost segregation savings calculator estimates your federal income tax savings and provides: Please fill out the form below with your property’s information, and you will be on. Web cost segregation made simple cost segregation is arguably the most powerful tax saving tool available to real estate. Web it was after that 1954 decision outlawing public school segregation that the u.s. Karen chenaille poster pro real estate agent sevierville,. To use the calculator, choose a property type/use (residential or. Web cost segregation studies, like other tax records, are subject to irs review. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation. Web a cost segregation study is a process that looks at each element of a property, splits them into different. Web to meet the irs’ expectations, a taxpayer needs to submit a “quality cost segregation report” supported by a “quality cost segregation. This process accelerated $392,321 of depreciation deductions for the client. Estimated allocation to 5, 7,. $ (must be over $100,000) land allocation *: Web the cost segregation savings calculator estimates your federal income tax savings and provides: A commercial or residential building may. Note that the property is. Web get this template here: However, one of the main purposes of. Web cost segregation studies are performed for federal income tax purposes; Web cost segregation is a tax planning tool that gives real estate investors the chance to accelerate the depreciation. Web cost segregation requires assigning the “proper recovery period” to each asset.Costsegregationstudy Advanced Tax Advisors

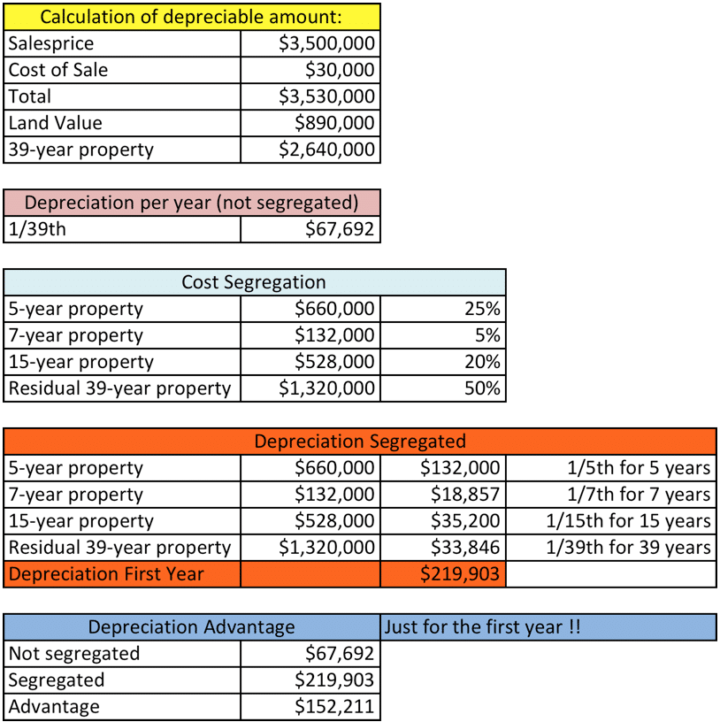

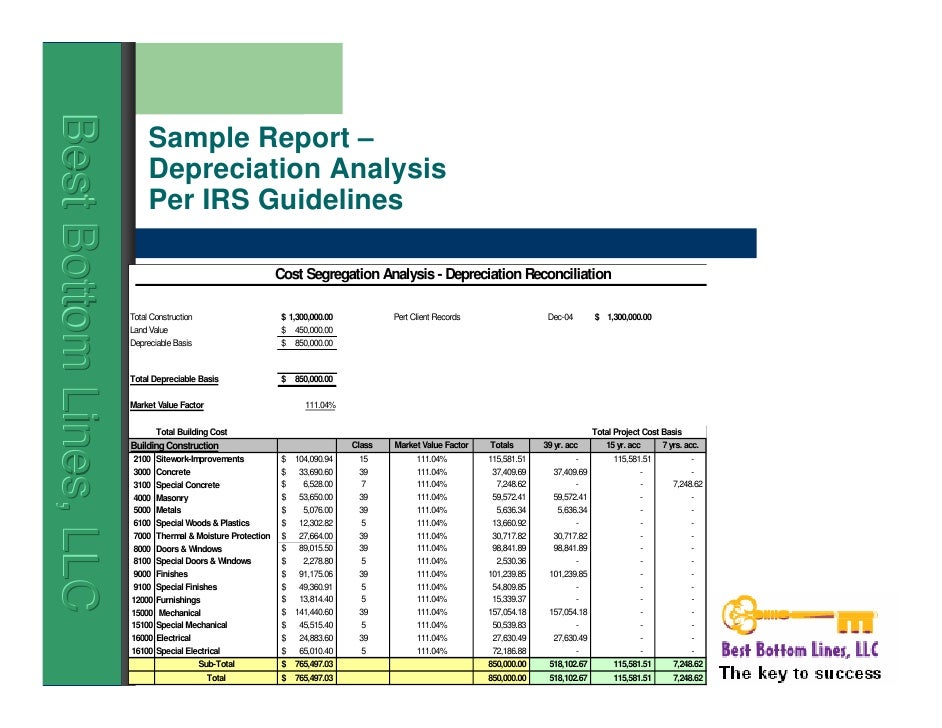

Simple Example of Cost Segregation Specializing in cost segregation

Cost Segregation, What Is It?

Cost Segregation Applied

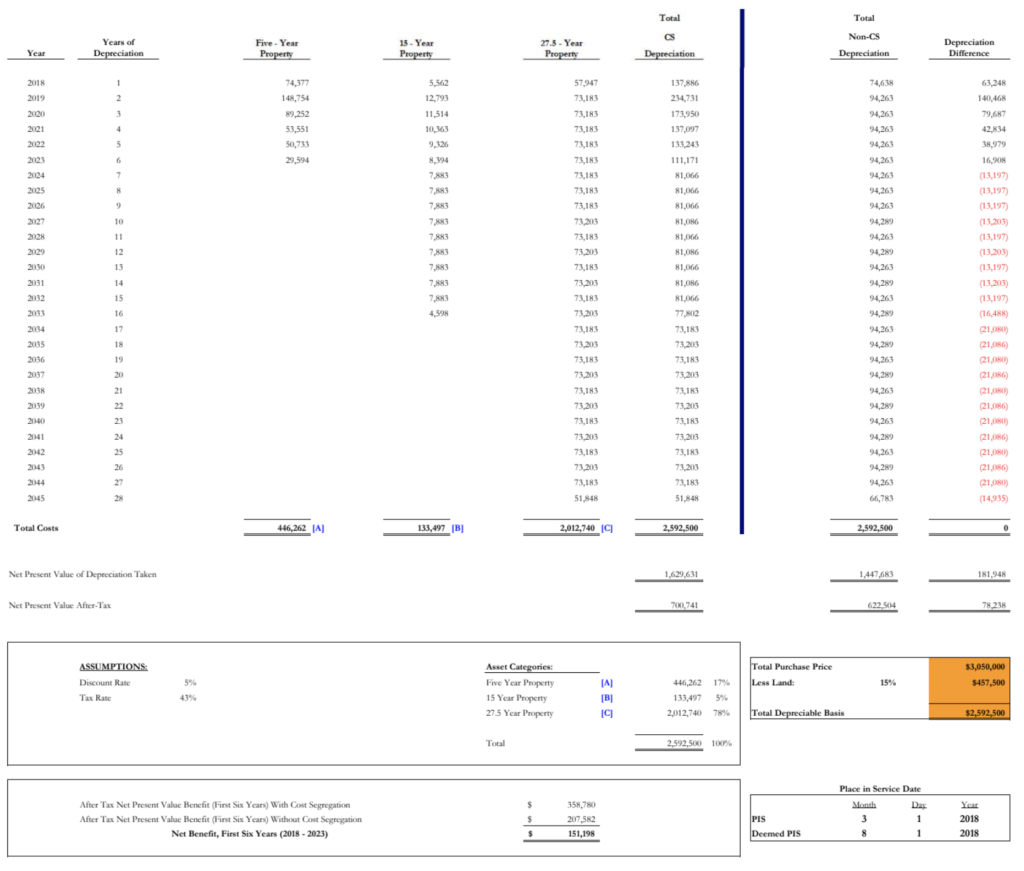

Cost Segregation Study

Cost Segregation & Bonus Depreciation Simple Passive Cashflow

Cost Segregation Analysis Seals the Deal Staebler Real Estate

Cost Segregation Explained CostControlTeam

Cost Segregation & Bonus Depreciation Simple Passive Cashflow

Cost Segregation Study

Related Post: