Employee Retention Credit Template

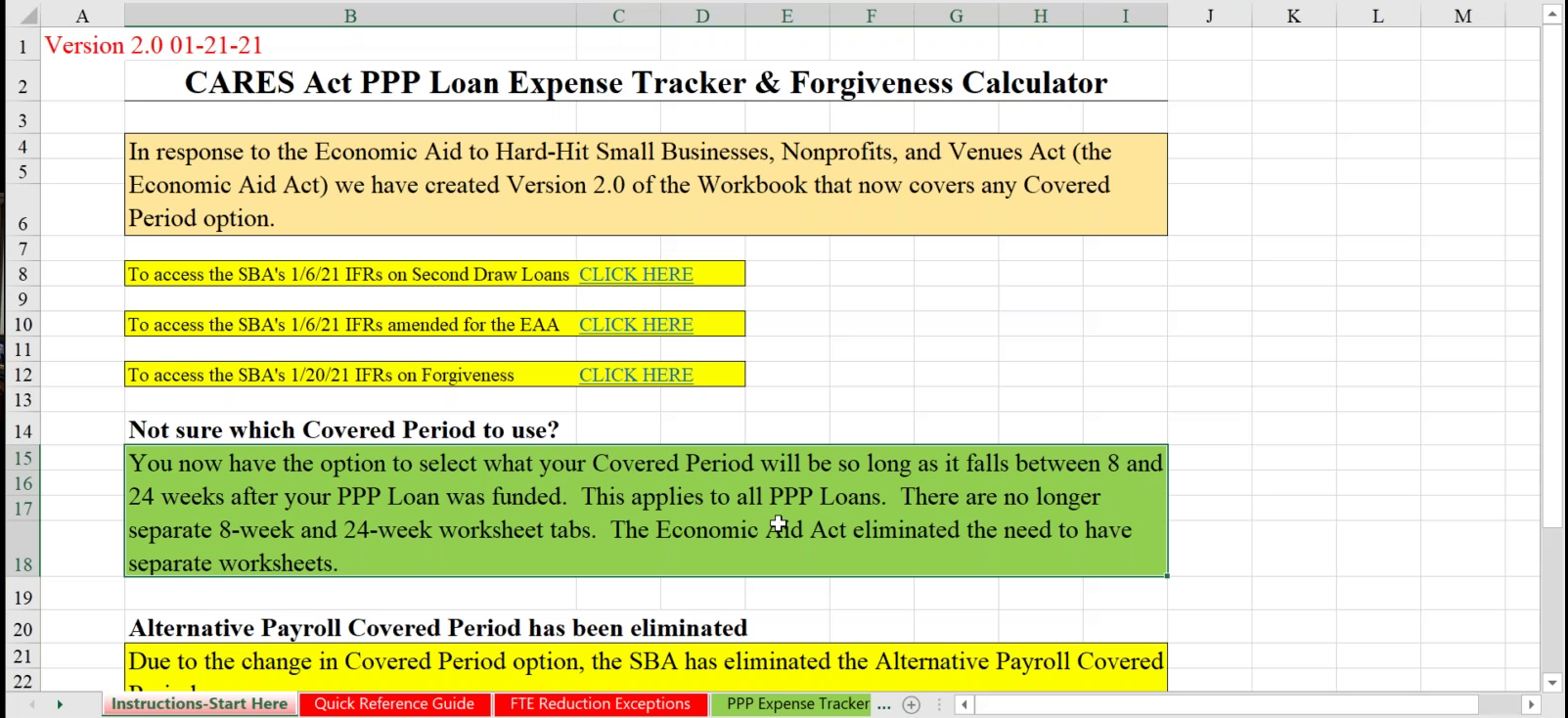

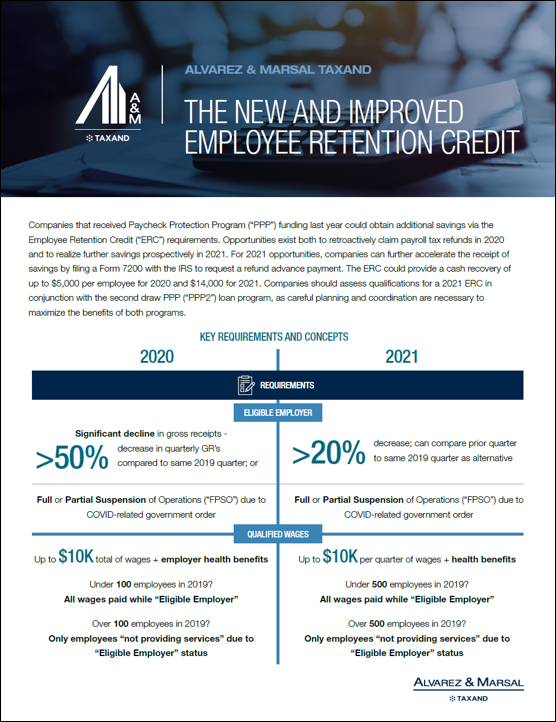

Employee Retention Credit Template - Web the erc can be up to $5,000 per employee (for 2020) and up to $21,000 per employee in 2021 so long as an eligible. Web the small business employee retention credit lets employers take a 70% credit up to $10,000 of an employee’s. Web from march 13, 2020, through dec. Enter a few data points to receive a free estimate. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. Determine business status step 5: In the event of a change of control (as defined below) occurring within 0 months of the effective. Web thus, the maximum employee retention credit available is $7,000 per employee per calendar quarter, for a total. A nonprofit with 20 employees example 2: Web the employee retention tax credit is essentially a refundable payroll tax credit that businesses could claim on. The following tools for calculating erc were. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. Web 2021 (caa) passed in late december 2020. Web the employee retention tax credit is essentially a refundable payroll tax credit that businesses could claim on. Look for advanced refund eligibility for erc worksheet. These programs provide a tax deferral or tax credit against employer. Web from march 13, 2020, through dec. Assess your qualified wages for each year step 6: Web get started with the ey employee retention credit calculator. Understand which quarters qualify step 2: Web beginning on january 1, 2021 and through june 30, 2021, eligible employers may claim a refundable tax credit against. Determine if you had a qualifying closure step 4: Web the small business employee retention credit lets employers take a 70% credit up to $10,000 of an employee’s. Web 2021 (caa) passed in late december 2020. Web get started with. The following tools for calculating erc were. In the event of a change of control (as defined below) occurring within 0 months of the effective. Web the small business employee retention credit lets employers take a 70% credit up to $10,000 of an employee’s. These programs provide a tax deferral or tax credit against employer. Web the federal government established. Determine if you had a qualifying closure step 4: Determine business status step 5: Web employee retention credit financial reporting & disclosure examples employee retention credit financial reporting & disclosure examples. Look for advanced refund eligibility for erc worksheet assistance, contact erc today Web from march 13, 2020, through dec. Assess your qualified wages for each year step 6: In the event of a change of control (as defined below) occurring within 0 months of the effective. Web level 1 posted october 02, 2020 05:44 am last updated october 02, 2020 5:44 am employee retention credit worksheet. The following tools for calculating erc were. Web to simplify the process of. Web employee retention credit examples example 1: A nonprofit with 20 employees example 2: 31, 2020, the credit cap was $5,000 per employee for the year. Web the employee retention and employee retention and rehiring tax credits the march 2020 coronavirus aid, relief, and. Web the employee retention tax credit is essentially a refundable payroll tax credit that businesses could. Look for advanced refund eligibility for erc worksheet assistance, contact erc today Web the employee retention credit is a complex credit that requires careful review before applying. Assess your qualified wages for each year step 6: Web 2021 (caa) passed in late december 2020. Enter a few data points to receive a free estimate. Web thus, the maximum employee retention credit available is $7,000 per employee per calendar quarter, for a total. In the event of a change of control (as defined below) occurring within 0 months of the effective. Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their. 31, 2020, the credit cap. Calculate the erc for your business step 7: Web to simplify the process of calculating the retention rate, we have created a simple and easy employee retention rate calculator excel template with predefined formulas. Look for advanced refund eligibility for erc worksheet assistance, contact erc today Web the employee retention credit (erc) is a refundable tax credit intended to encourage. Understand which quarters qualify step 2: Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their. Web the small business employee retention credit lets employers take a 70% credit up to $10,000 of an employee’s. Enter a few data points to receive a free estimate. Web the erc can be up to $5,000 per employee (for 2020) and up to $21,000 per employee in 2021 so long as an eligible. Web practitioners are sure to see a lot of employee retention credit (erc) issues. Web employee retention credit examples example 1: Web for each 2021 quarter, an eligible employer can credit up to $10,000 in qualified wages per employee. Web this is a completely adaptable powerpoint template design that can be used to interpret topics like mitigate, mobilize, maintain,. Web get started with the ey employee retention credit calculator. Web beginning on january 1, 2021 and through june 30, 2021, eligible employers may claim a refundable tax credit against. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. Web to simplify the process of calculating the retention rate, we have created a simple and easy employee retention rate calculator excel template with predefined formulas. Web the employee retention and employee retention and rehiring tax credits the march 2020 coronavirus aid, relief, and. Calculate the erc for your business step 7: Web the employee retention credit is a complex credit that requires careful review before applying. Assess your qualified wages for each year step 6: Determine if you had a qualifying closure step 4: Web level 1 posted october 02, 2020 05:44 am last updated october 02, 2020 5:44 am employee retention credit worksheet. Look for advanced refund eligibility for erc worksheet assistance, contact erc todayEmployee Retention Credit Form MPLOYME

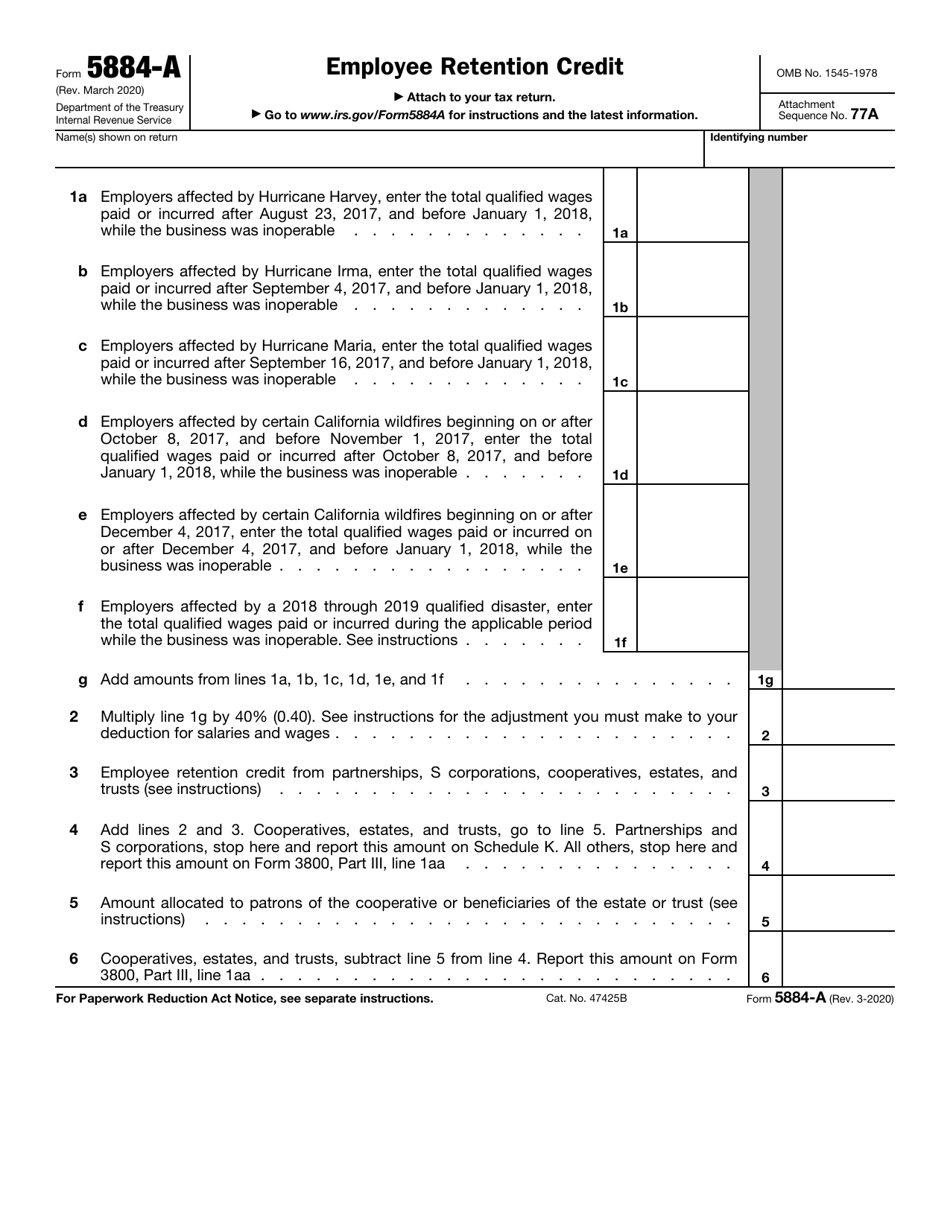

IRS Form 5884A Download Fillable PDF or Fill Online Employee Retention

Employee Retention Credit (ERC) Calculator Gusto

Employee Retention Bonus Agreement Template [Free PDF] Google Docs

Employee Retention Credit Form MPLOYME

COVID19 Relief Legislation Expands Employee Retention Credit

The Employee Retention Credit Report Issue 298 Gassman, Crotty

The New and Improved Employee Retention Credit Alvarez & Marsal

Employee Retention Credit Form MPLOYME

Employee Retention Credit Form MPLOYME

Related Post:

![Employee Retention Bonus Agreement Template [Free PDF] Google Docs](https://images.template.net/44646/Employee-Retention-Bonus-Agreement-Template-1.jpeg)