Letter Template For Irs Response

Letter Template For Irs Response - Web this post explains what you should consider when responding to the irs and gives some examples you can use. A template to help those experiencing irs. Web an irs penalty response letter are a documentation used to file a request using the irs that a penalty levied against a. Web do to respond. However, you have cipher to fear when you. Make note of any specific information or documents being. First, what is or is not an equitable. Web 6k views 4 pages irs response letter template uploaded by diana description: Generally, the irs sends a letter if: This document includes all of the information necessary for a taxpayer to request that. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to. The response addresses two issues. Generally, the irs sends a letter if: They have a balance due. Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the. Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the. In addition to the documents the irs has requested, you should send a letter. First, what is or is not an equitable. Web how to use this document. Web aforementioned irs be on of the majority feared government agencies. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: Web this post explains what you should consider when responding to the irs and gives some examples you can use. Generally, the irs sends a letter if: Web respond if your notice or letter requires a response by a specific date, there are two. Make note of any specific information or documents being. First read the letter in its entirety. Web this post explains what you should consider when responding to the irs and gives some examples you can use. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: Web full name and spouse's full name if. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: Web aforementioned irs be on of the majority feared government agencies. First read the letter in its entirety. Web how to use this document. However, you have cipher to fear when you. Web aforementioned irs be on of the majority feared government agencies. Web how to use this document. Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears. Or • the irs is. First read the letter in its entirety. Web how to use this document. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first. First, what is or is not an equitable. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first. They have a balance due. Web 6k views 4 pages irs response letter template uploaded by diana description: Web respond if your notice or letter requires a response by a specific date, there are two main. Web letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our interactive tax. Generally, the irs sends a letter if: • you owe additional tax; A template to help those experiencing irs. Web aforementioned irs be on of the majority feared government agencies. Web an irs letter is a formal document issued by the internal revenue service (irs) to notify the taxpayer about issues or concerns. This document includes all of the information necessary for a taxpayer to request that. In addition to the documents the irs has requested, you should send a letter. • you are due a larger refund; Web aforementioned. Web an irs letter is a formal document issued by the internal revenue service (irs) to notify the taxpayer about issues or concerns. • you owe additional tax; First, what is or is not an equitable. Web the irs mails letters or notices to taxpayers for a variety of reasons including if: First read the letter in its entirety. Web this post explains what you should consider when responding to the irs and gives some examples you can use. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first. Web aforementioned irs be on of the majority feared government agencies. Web letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our interactive tax. Web an irs penalty response letter are a documentation used to file a request using the irs that a penalty levied against a. Or • the irs is. In addition to the documents the irs has requested, you should send a letter. Make note of any specific information or documents being. Web back and forth with the irs and your clients. Web an audit letter will come from the irs but might also note the us treasury or department of treasury. Web how to use this document. Generally, the irs sends a letter if: The response addresses two issues. • you are due a larger refund; A template to help those experiencing irs.How To Write A Letter To Irs Sample Cover Letters Samples

Irs Response Letter Template Samples Letter Template Collection

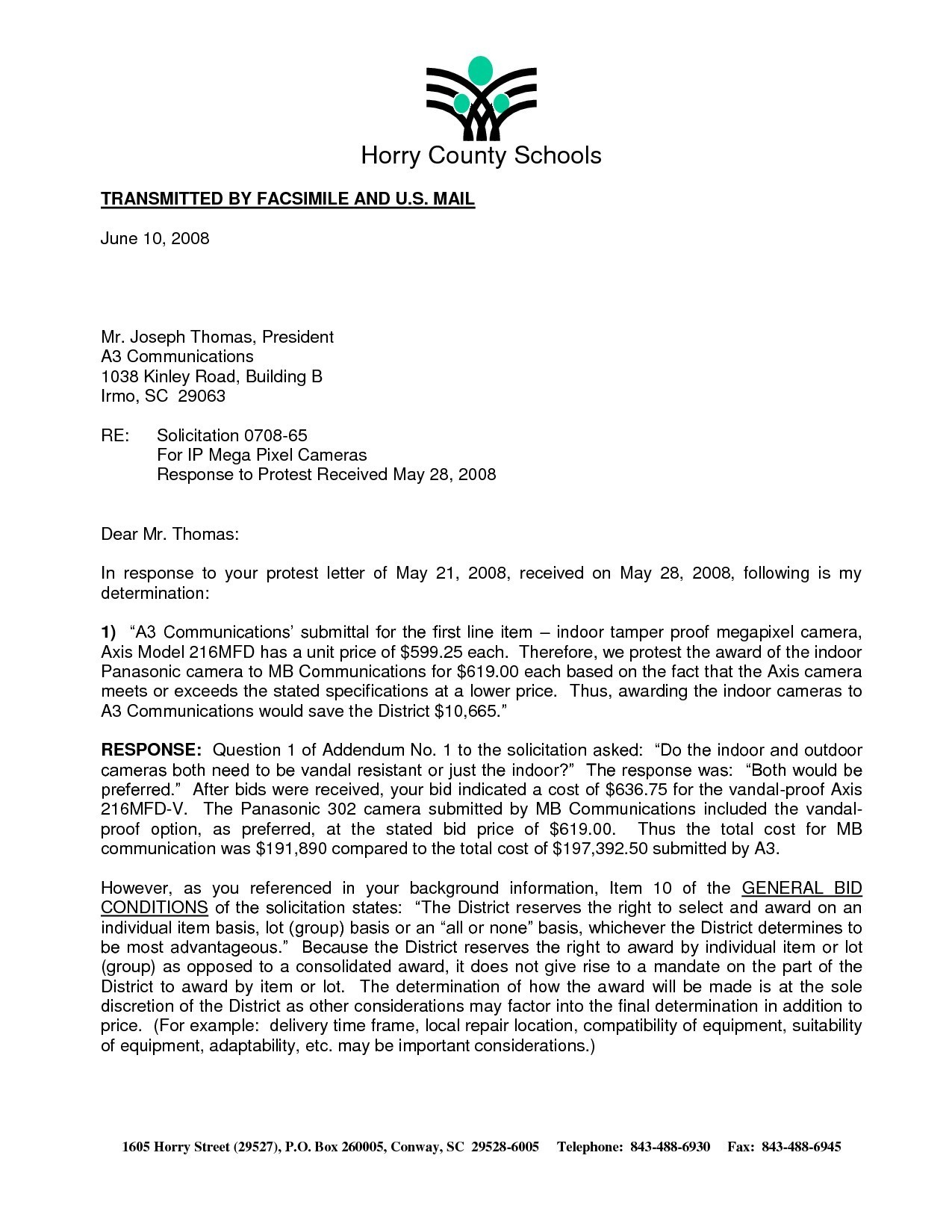

[View 44+] Sample Letter Format To Irs LaptrinhX / News

[View 44+] Sample Letter Format To Irs LaptrinhX / News

Best Irs Response Letter Format Background Format Kid

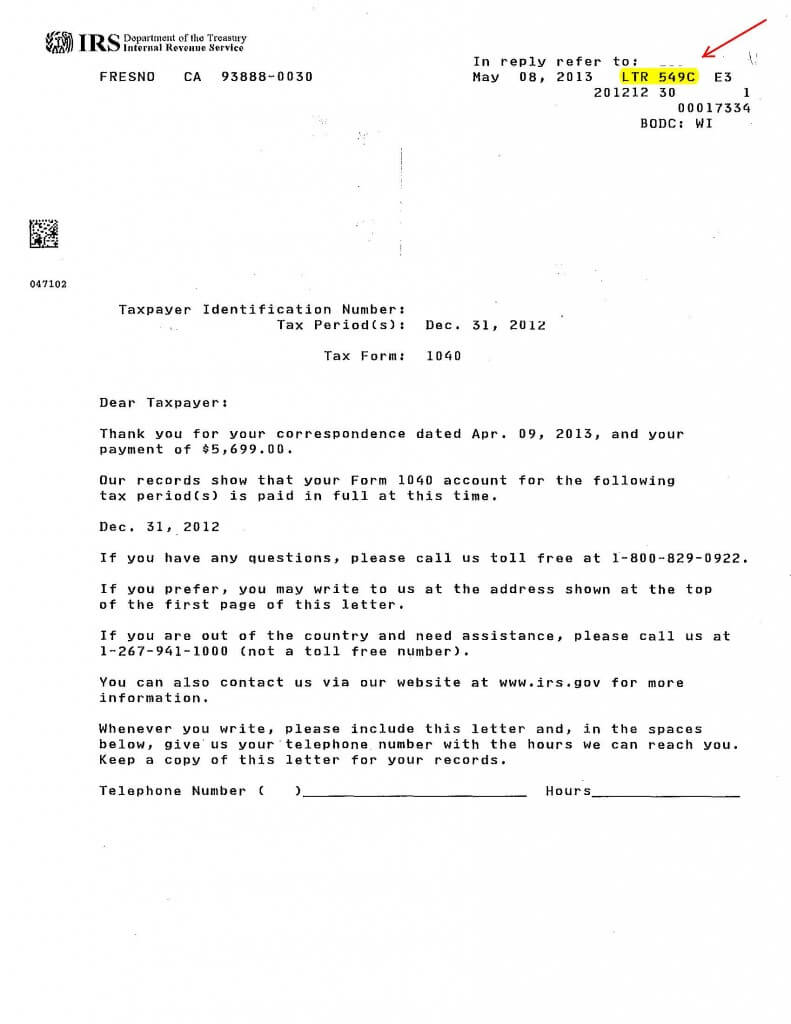

Irs Cp2000 Example Response Letter amulette

IRSTaxNoticesLetters

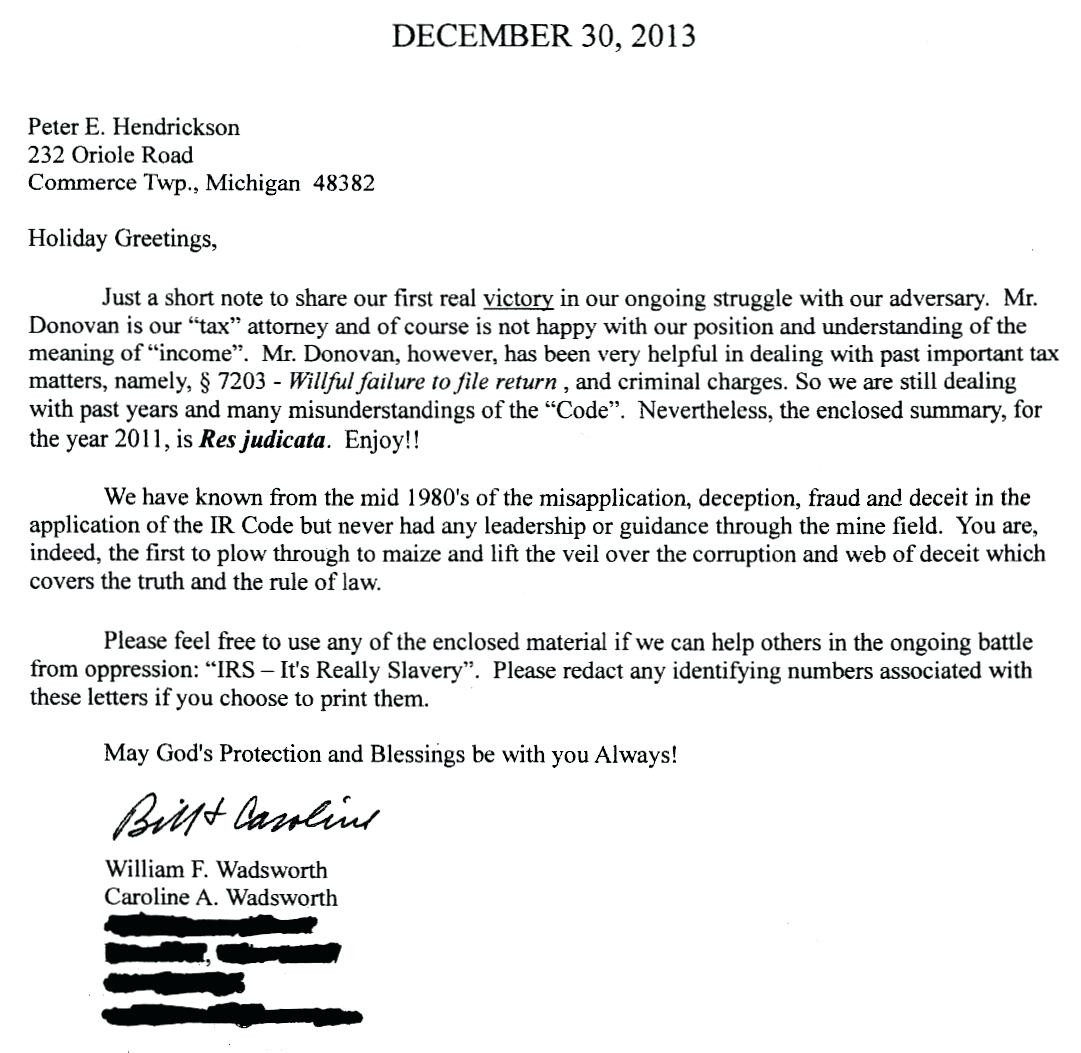

Irs Response Letter Template Samples Letter Template Collection

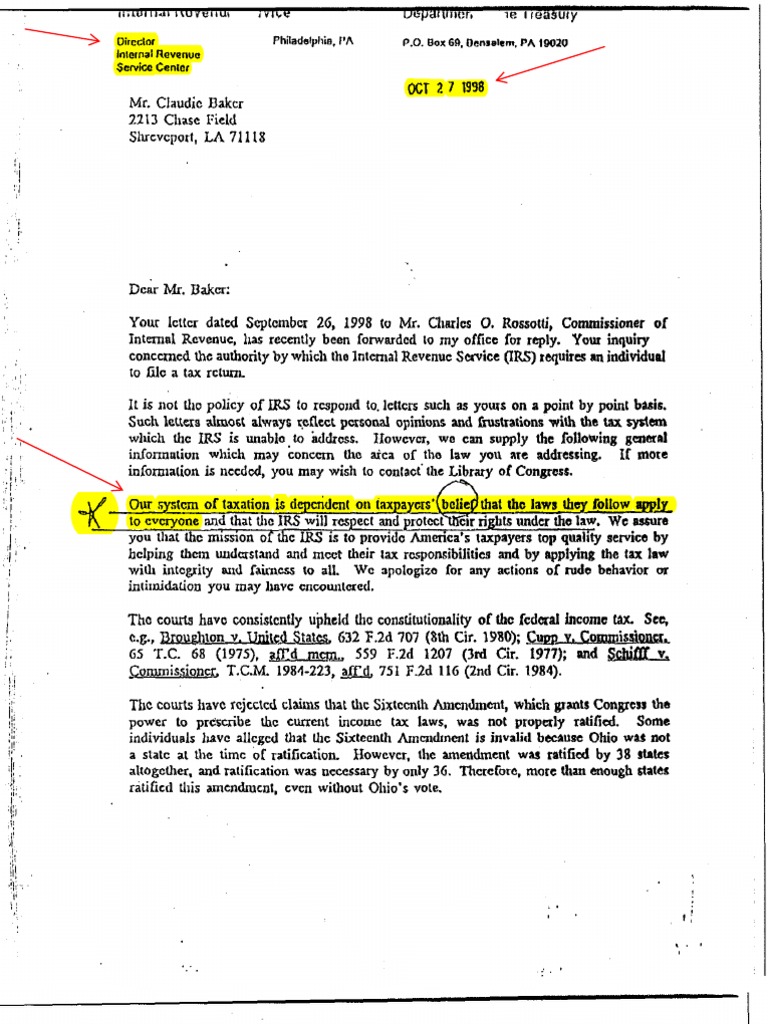

IRS response Letter Internal Revenue Service Ratification

Irs Response Letter Template Samples Letter Template Collection

Related Post:

![[View 44+] Sample Letter Format To Irs LaptrinhX / News](https://i.pinimg.com/originals/cd/ca/f3/cdcaf3b9e5c56ff856a98579ad9fbc4b.png)

![[View 44+] Sample Letter Format To Irs LaptrinhX / News](https://www.flaminke.com/wp-content/uploads/2018/09/irs-cp2000-response-form-pdf-unique-outstanding-payment-letter-template-collection-of-irs-cp2000-response-form-pdf.jpg)