Present Value Excel Template

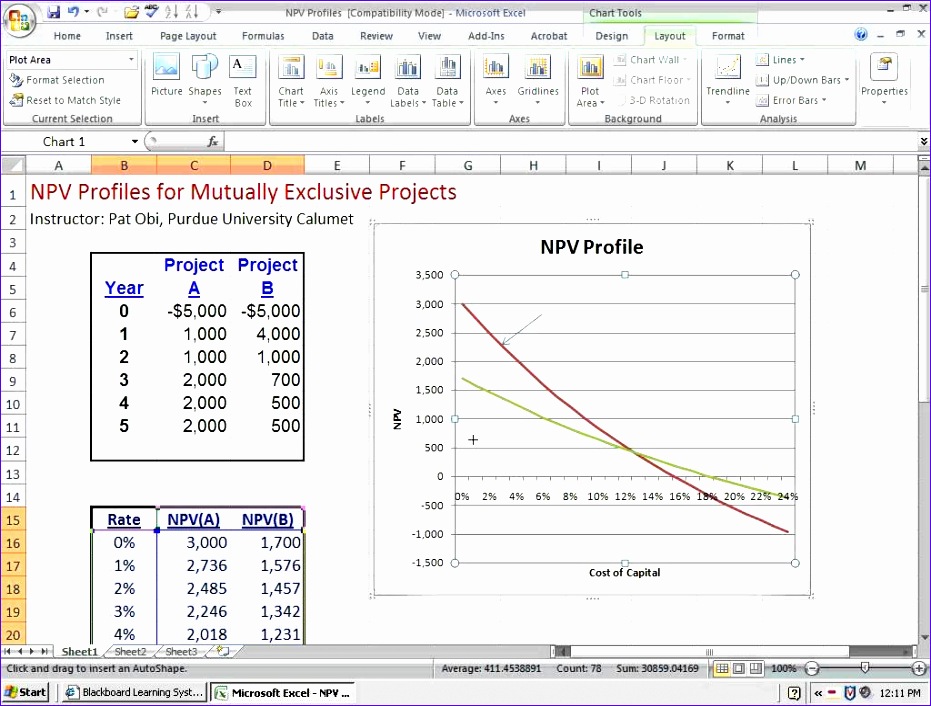

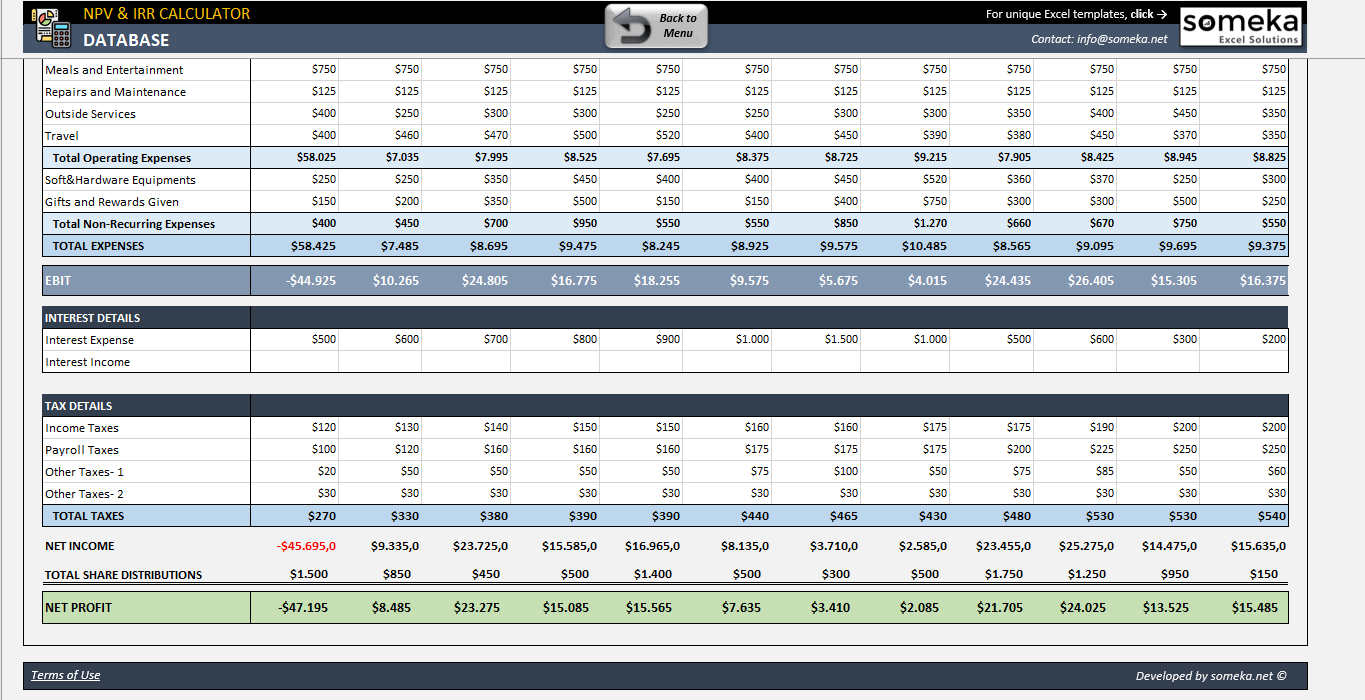

Present Value Excel Template - Pv ( rate, nper, [pmt], [fv], [type] ) where, rate is the interest rate per period (as a decimal or a. The formula for present value is: Web the present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now. Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Web the excel pv function is a financial function that returns the present value of an investment. Web it is used to determine the profitability you derive from a project. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the. Web net present value ( npv) is a core component of corporate budgeting. Web the present value of annuity can be defined as the current value of a series of future cash flows, given a. Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the. Web present value (pv)—also known as a discount value—measures the value of future cash. Web the syntax of the pv function is: April 12, 2022 net present value is used in capital budgeting and. The formula for present value is: This net present value template helps you calculate net present value given the. Web it is used to determine the profitability you derive from a project. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Its value with all equity financing. This net present value template helps you calculate net present value given the. Web the correct npv formula in excel uses the npv function to calculate the present value of. What is a present value? Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web the syntax of the pv function is: Present value is the current worth of a future. Web the syntax of the pv function is: The first worksheet is used to calculate present value based on. Web it is used to determine the profitability you derive from a project. Web the excel pv function is a financial function that returns the present value of an investment. Web npv calculates that present value for each of the series. Web net present value ( npv) is a core component of corporate budgeting. The first worksheet is used to calculate present value based on. Web what is the pv function? Web the excel pv function is a financial function that returns the present value of an investment. Web this present value or pv calculator consist of three worksheets. The pv function [1] is a widely used financial function in microsoft excel. Web the present value of annuity can be defined as the current value of a series of future cash flows, given a. Similarly, we have to calculate it for. The first worksheet is used to calculate present value based on. April 12, 2022 net present value is. The term “present value” refers to the application of the time value. Web the excel pv function is a financial function that returns the present value of an investment. Web this article describes the formula syntax and usage of the npv function in microsoft excel. Web it is used to determine the profitability you derive from a project. The first. Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and. Present value is the current worth of a future sum of money or stream of cash flows. The term “present value” refers to the application of the time value. Web the present value of annuity can. The formula for present value is: April 12, 2022 net present value is used in capital budgeting and. Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the. Web the present value of annuity can be defined as the current value of a series of future. First, we have to calculate the present value the output will be: Where, pv = present value. Web the present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now. Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the. Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. Web net present value excel template updated: Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Web how do you calculate present value? Web this present value or pv calculator consist of three worksheets. Pv ( rate, nper, [pmt], [fv], [type] ) where, rate is the interest rate per period (as a decimal or a. Web the excel pv function is a financial function that returns the present value of an investment. Web it is used to determine the profitability you derive from a project. It is a comprehensive way to calculate whether. The term “present value” refers to the application of the time value. It calculates the present value of a loan or an. Web the syntax of the pv function is: Web net present value ( npv) is a core component of corporate budgeting. This net present value template helps you calculate net present value given the. Similarly, we have to calculate it for. Present value is the current worth of a future sum of money or stream of cash flows.How to calculate Present Value using Excel

10 Excel Net Present Value Template Excel Templates

Net Present Value Calculator Excel Templates

Net Present Value Calculator Excel Template SampleTemplatess

10 Excel Net Present Value Template Excel Templates

Best Net Present Value Formula Excel transparant Formulas

Net Present Value Formula Examples With Excel Template

Fantastic Net Present Value Excel Template Riteforyouwellness

Professional Net Present Value Calculator Excel Template Excel TMP

8 Npv Calculator Excel Template Excel Templates

Related Post: