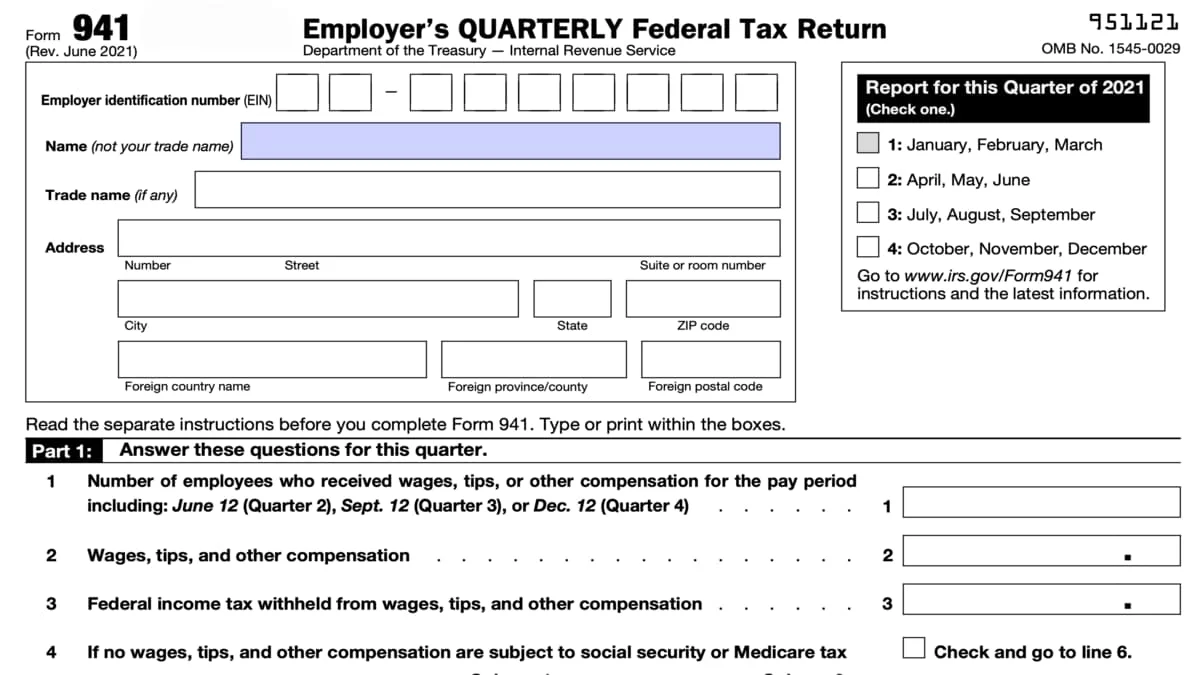

Statement Of Final Return 941 Template

Statement Of Final Return 941 Template - March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web complete our statement of final return template (located at end of this document), or write your. The typical quarterly due date for the form is 30 days following. Web free form 941 to download. Web form 941 for 2021: Web final 941 form but forget to mark it as final hi, i just filed my 941 for q2 2022 and it was accepted. Choose the reason this will be the final return (closed, sale, or transfer). Web type of final return. Web generally, you must file form 941, employer's quarterly federal tax return or form 944, employer's annual. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee. Form 940 and state annual forms; Web i can share some information on how to process an employee's final payroll and generate a statement of final. The typical quarterly due date for the form is 30 days following. Web final 941 form but forget to mark it as final hi, i just filed my 941 for q2 2022 and it. Web form 941 for 2021: To mark the final return checkbox on form 94x, the inactive date entered for. Web free form 941 to download. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web i can share some information on how to process an employee's final payroll and generate a statement of final. Web form 941 for 2023: Form 940 and state annual forms; Choose the reason this will be the final return (closed, sale, or transfer). Web information about form 941, employer's journal federal irs return, comprising current previous, relates forms, and instructions. Web complete our statement of final return template (located at end of this document), or write your. Web i can share some information on how to process an employee's final payroll and generate a statement of final. Web final 941 form but forget to mark it as final hi, i just filed my 941 for q2 2022 and it was accepted. 2 printable templates, samples & charts in pdf, word, excel formats. Web form 941 pdf instructions. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee. Web free form 941 to download. Web what is form 941? Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual. To mark the final return checkbox on form 94x, the inactive date entered for. Choose the reason this will be the final return (closed, sale, or transfer). Web 20 comments honeylynn_g quickbooks team january 22, 2019 06:04 pm good day, @mweakley. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web form 941 for 2021: Web complete our statement of final return template (located at. Web free form 941 to download. To mark the final return checkbox on form 94x, the inactive date entered for. Web information around form 941, employer's annually federal tax return, including recent updates, related forms, and instructions on. Web complete our statement of final return template (located at end of this document), or write your. Web form 941 for 2023: To mark the final return checkbox on form 94x, the inactive date entered for. Web type of final return. Web final 941 form but forget to mark it as final hi, i just filed my 941 for q2 2022 and it was accepted. Web form 941 for 2021: Choose the reason this will be the final return (closed, sale, or. Web form 941 pdf instructions for form 941 ( print version pdf) recent developments early termination of the employee. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. The typical quarterly due date for the form is 30 days following. Choose the reason this will be the final return (closed, sale,. Web form 941 and state quarterly forms; Web form 941 for 2021: Form 940 and state annual forms; Web type of final return. March 2021) employer’s quarterly federal tax return department of the treasury — internal. Web final 941 form but forget to mark it as final hi, i just filed my 941 for q2 2022 and it was accepted. Web i can share some information on how to process an employee's final payroll and generate a statement of final. March 2023) employer’s quarterly federal tax return department of the treasury — internal. Web information about form 941, employer's journal federal irs return, comprising current previous, relates forms, and instructions. Web 20 comments honeylynn_g quickbooks team january 22, 2019 06:04 pm good day, @mweakley. Web mark the final return checkbox on form 940 or 941. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web form 941 and state quarterly forms; Web form 941 pdf instructions for form 941 ( print version pdf) recent developments early termination of the employee. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee. Web generally, you must file form 941, employer's quarterly federal tax return or form 944, employer's annual. Form 940 and state annual forms; Web complete our statement of final return template (located at end of this document), or write your. Web form 941 for 2021: 2 printable templates, samples & charts in pdf, word, excel formats. Web form 941 for 2023: Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual. Web type of final return. Web free form 941 to download. March 2021) employer’s quarterly federal tax return department of the treasury — internal.941 Form 2022 Printable PDF Template

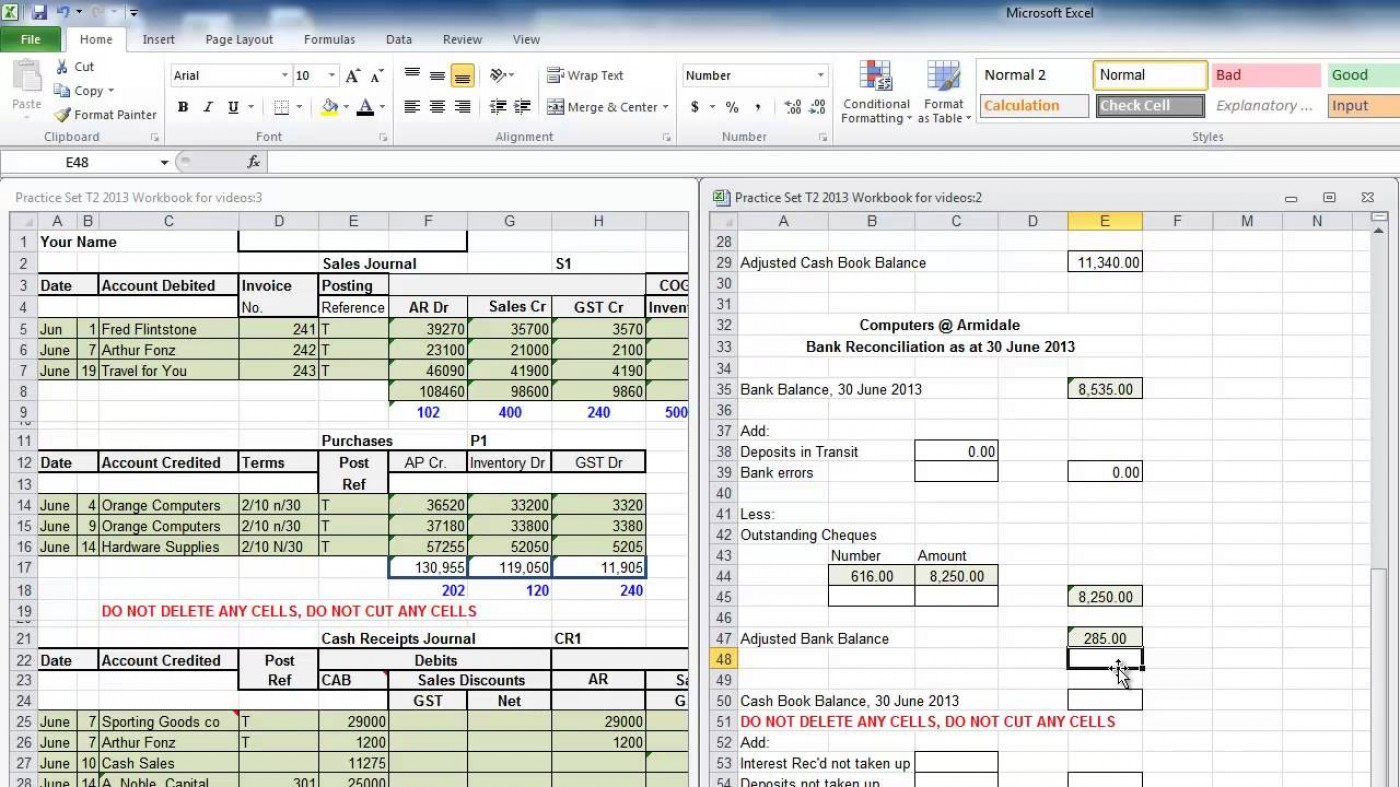

Inventory Reconciliation Format In Excel Excel Templates

Form 941 Employer's Quarterly Federal Tax Return Definition

Quarterly Federal Return (941)

How to fill out IRS Form 941 2019 PDF Expert

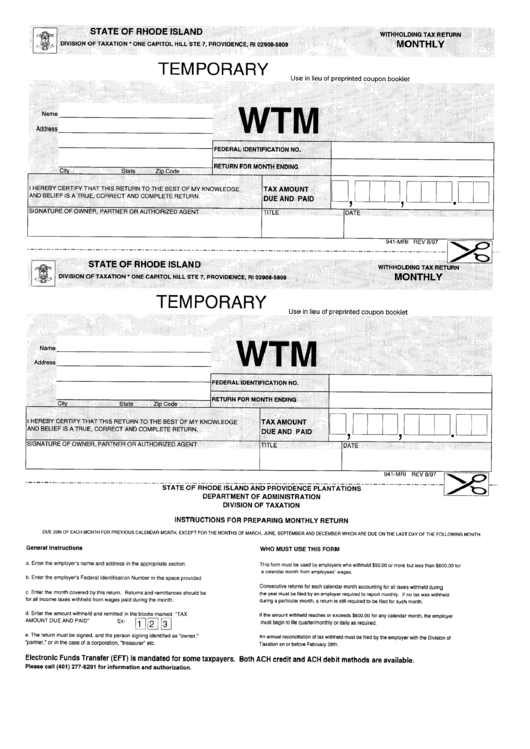

Form 941Mri Monthly Withholding Tax Return printable pdf download

FREE 10+ Sample Statement of Account in PDF

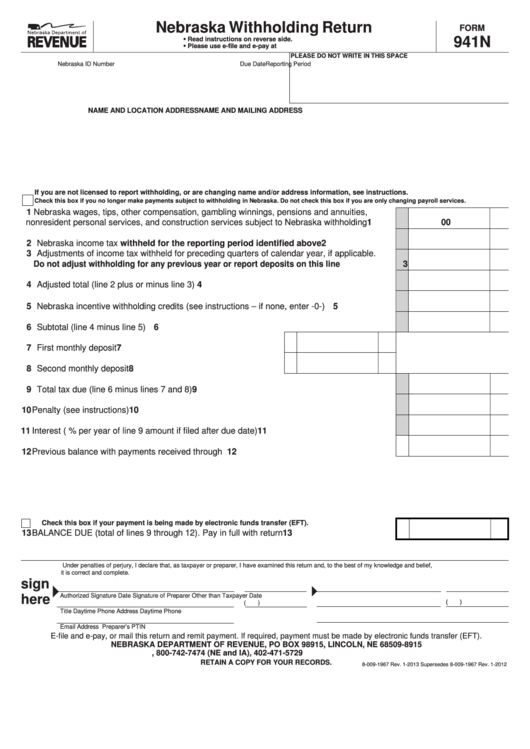

Form 941n Nebraska Withholding Return printable pdf download

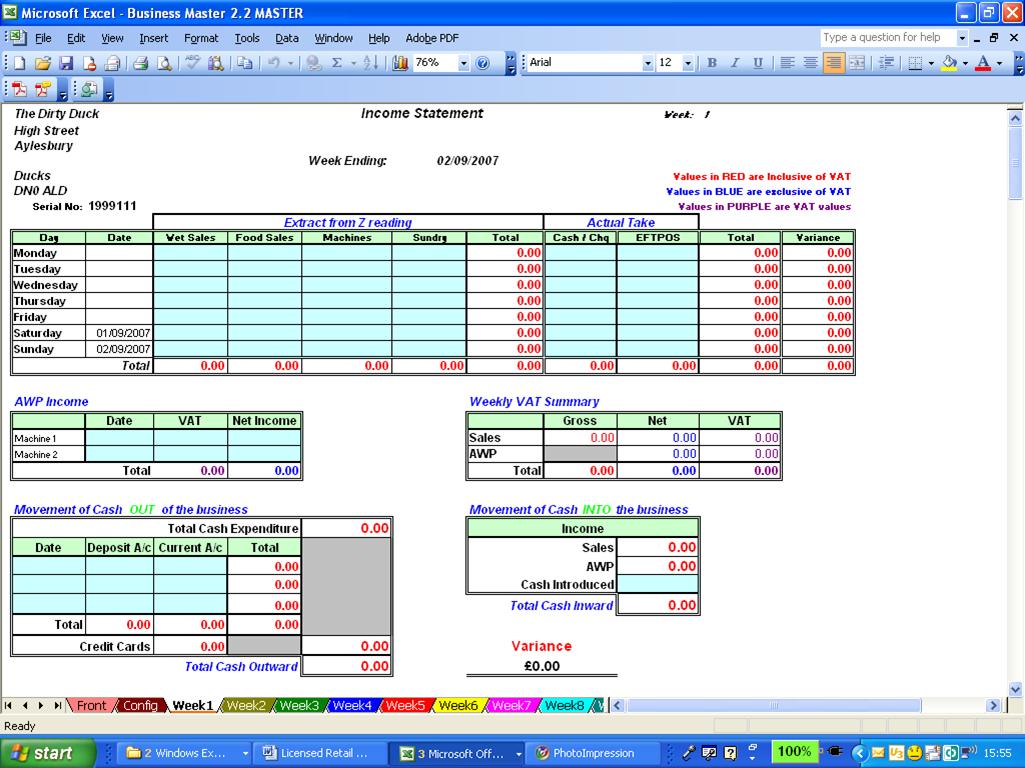

Vat Reconciliation Spreadsheet —

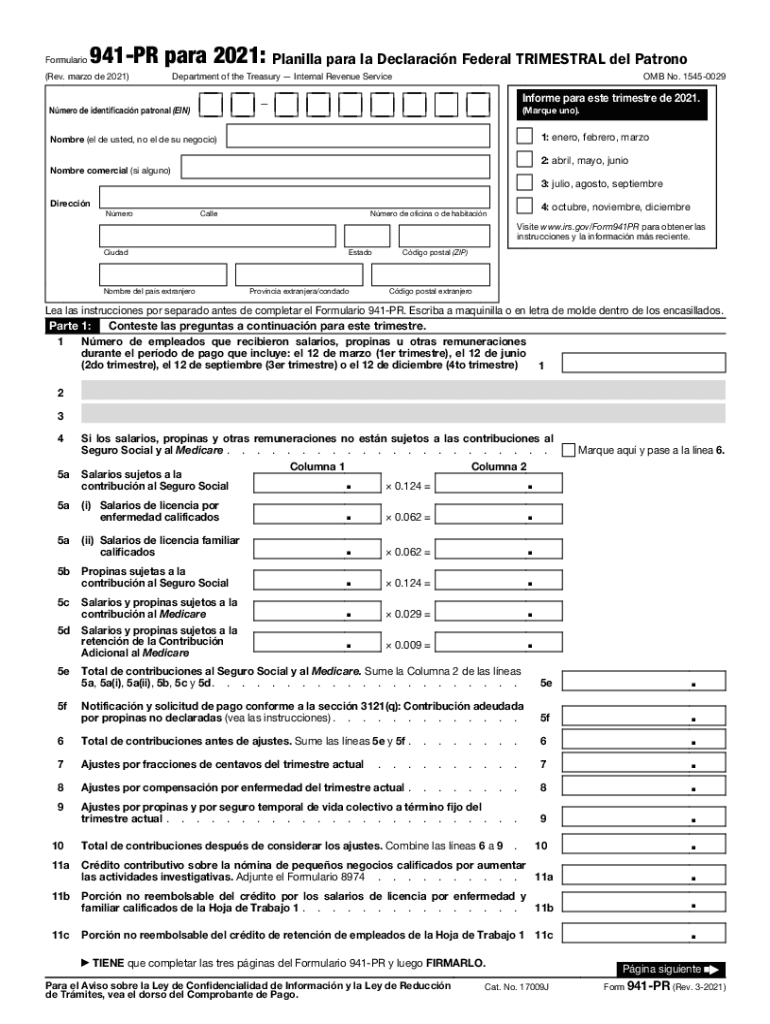

941 Pr 2021 Form Fill Out and Sign Printable PDF Template signNow

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)