Tax Deductible Donation Receipt Template

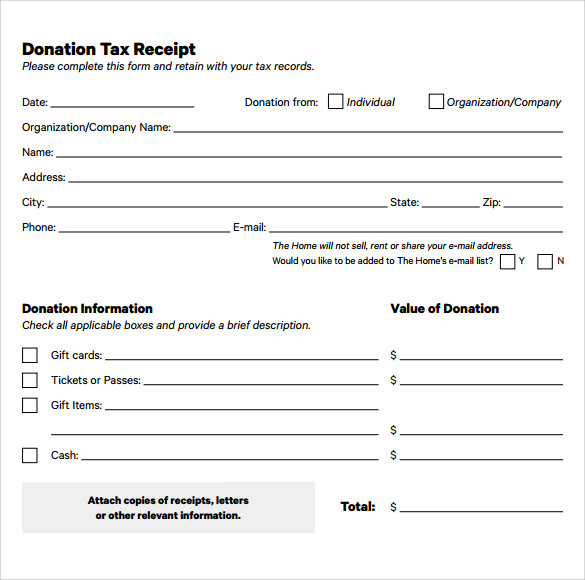

Tax Deductible Donation Receipt Template - Web your amazing donation of $250 has a tax deductible amount of $200. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs. A donation receipt template is used as proof that cash or property was gifted to your charity. Web the organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. Web here are some best practices to follow when creating a donation receipt template: Your donation must meet certain. The written acknowledgment required to substantiate a charitable contribution of $250 or. Web what is a donation receipt template and why do you need one? Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. Web the receipt template is a microsoft word document so that you can customize it and make it work for your organization. Web what is a donation receipt template and why do you need one? Made to meet canada and which usa. Don’t worry, we’ll also send out a year. Is it a gift or contribution? Web the organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. Web required statements there are statements that are required by the irs when creating a donation receipt in order for it to be. Web your amazing donation of $250 has a tax deductible amount of $200. Web pk !^æ2 '' mimetypeapplication/vnd.oasis.opendocument.textpk !øÿ“¨. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs. Is it a gift or contribution? The first template is for donations under $250, and the second is for contributions of $250 or more. Don’t worry, we’ll also send out a year. Your donation must meet certain. Is it a gift or contribution? The first template is for donations under $250, and the second is for contributions of $250 or more. Web required statements there are statements that are required by the irs when creating a donation receipt in order for it to be. Web depending on the donation type, a donor may need to obtain a. Your donation must meet certain. Web your amazing donation of $250 has a tax deductible amount of $200. Legal requirements the irs demands donors to present their donation receipts in a few cases. Below, you will find a receipt for your records. Web required statements there are statements that are required by the irs when creating a donation receipt in. Is it a gift or contribution? Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs. The first template is for donations under $250, and the second is for contributions of $250 or more. The written acknowledgment required to substantiate a charitable contribution of $250 or. Web the organization. Legal requirements the irs demands donors to present their donation receipts in a few cases. Web what is a donation receipt template and why do you need one? Don’t worry, we’ll also send out a year. Below, you will find a receipt for your records. Web text receipt for donations template view & download email template for charitable donation receipt. A donation receipt template is used as proof that cash or property was gifted to your charity. Web the receipt template is a microsoft word document so that you can customize it and make it work for your organization. The written acknowledgment required to substantiate a charitable contribution of $250 or. Is it a gift or contribution? Legal requirements the. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs. Web your amazing donation of $250 has a tax deductible amount of $200. Is it a gift or contribution? Below, you will find a receipt for your records. Web the receipt template is a microsoft word document so that. Web the organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. Don’t worry, we’ll also send out a year. Your donation must meet certain. Web pk !^æ2 '' mimetypeapplication/vnd.oasis.opendocument.textpk !øÿ“¨ settings.xmlœtënã0 ¼#ñ ‘9§né…z. Web free nonprofit donation receipt templates for every make scenario. Web text receipt for donations template view & download email template for charitable donation receipt an email is a good way to provide. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a. Web your amazing donation of $250 has a tax deductible amount of $200. A donation receipt template is used as proof that cash or property was gifted to your charity. Web the receipt template is a microsoft word document so that you can customize it and make it work for your organization. Web here are some best practices to follow when creating a donation receipt template: Below, you will find a receipt for your records. Legal requirements the irs demands donors to present their donation receipts in a few cases. Web what is a donation receipt template and why do you need one? Web free nonprofit donation receipt templates for every make scenario. Web according to the irs website : The written acknowledgment required to substantiate a charitable contribution of $250 or. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs. Donation receipts are used by charities while filing taxes and by donors to claim income tax deductions. Don’t worry, we’ll also send out a year. Web required statements there are statements that are required by the irs when creating a donation receipt in order for it to be. Web pk !^æ2 '' mimetypeapplication/vnd.oasis.opendocument.textpk !øÿ“¨ settings.xmlœtënã0 ¼#ñ ‘9§né…z. Web the organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. Made to meet canada and which usa. The first template is for donations under $250, and the second is for contributions of $250 or more.FREE 9+ Donation Receipt Templates in Google Docs Google Sheets

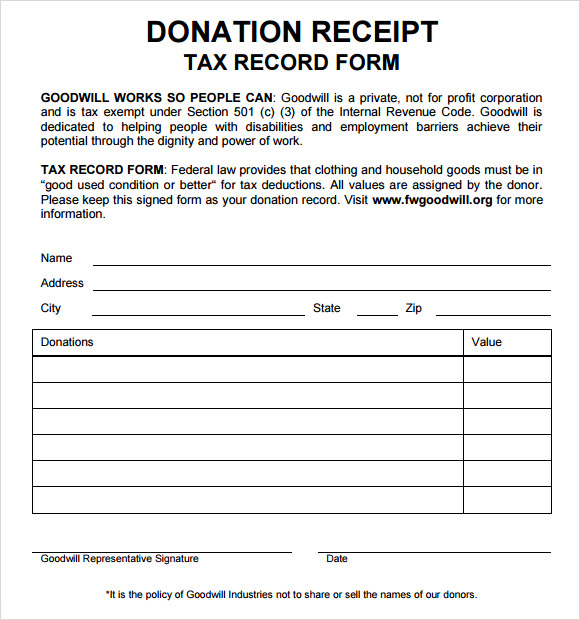

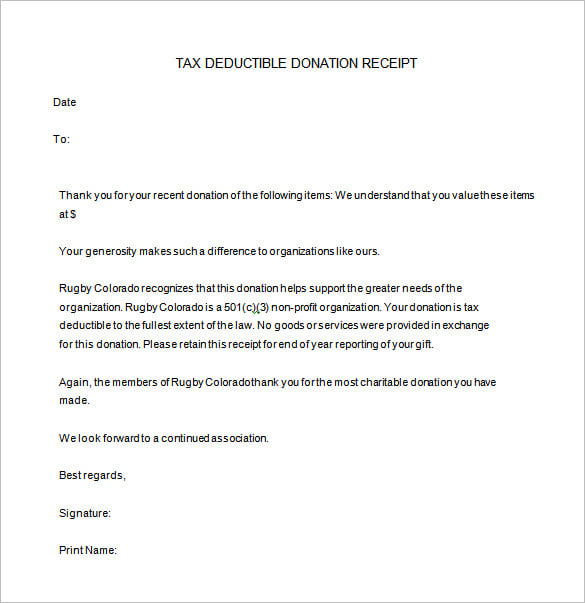

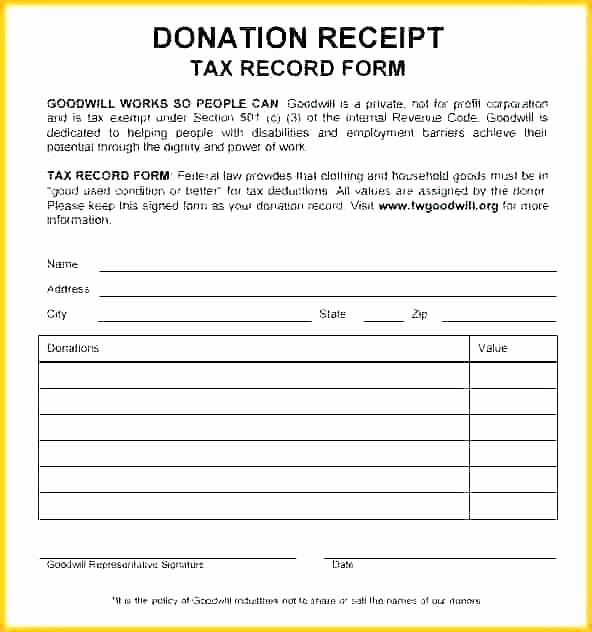

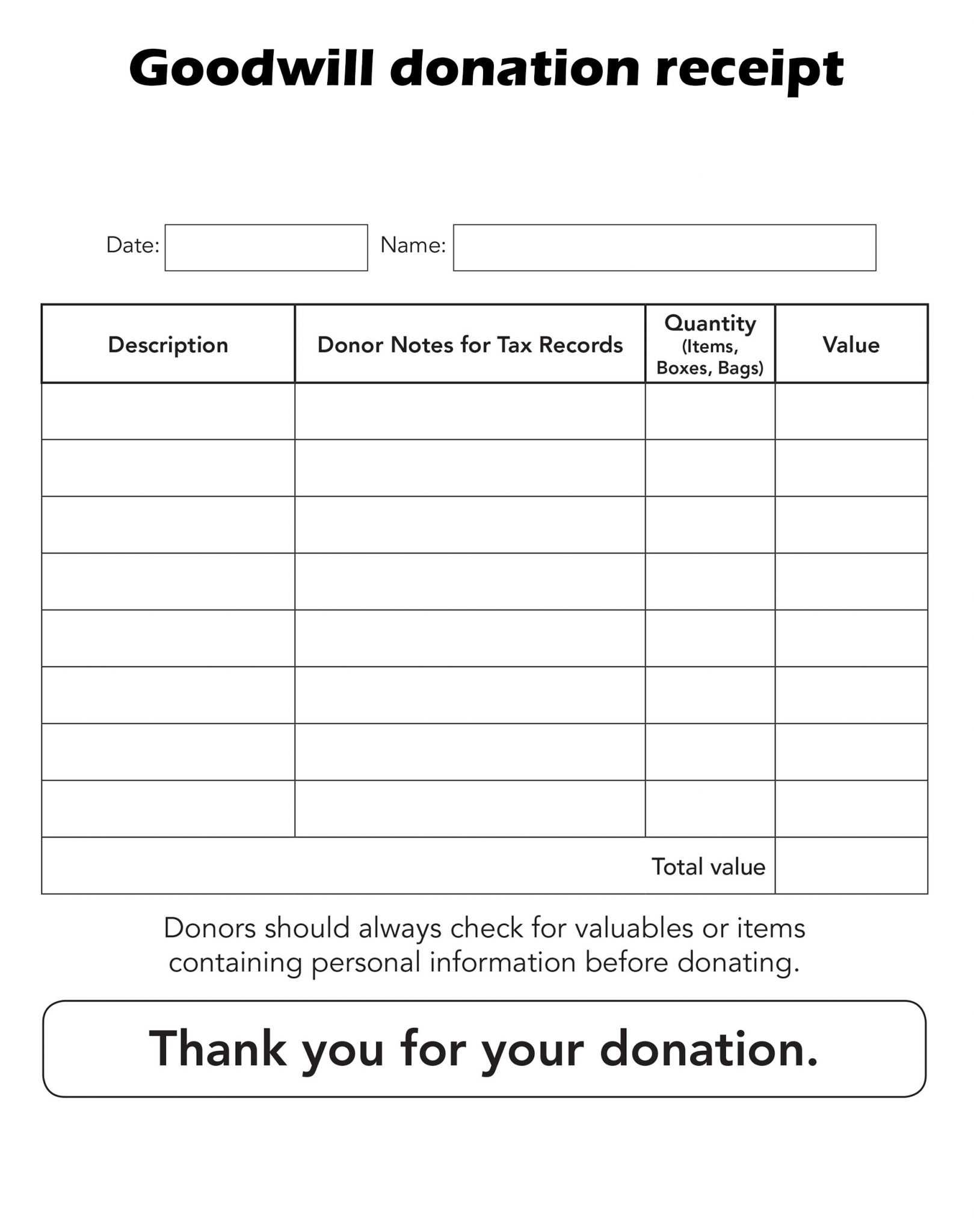

19+ Donation Receipt Templates DOC, PDF Free & Premium Templates

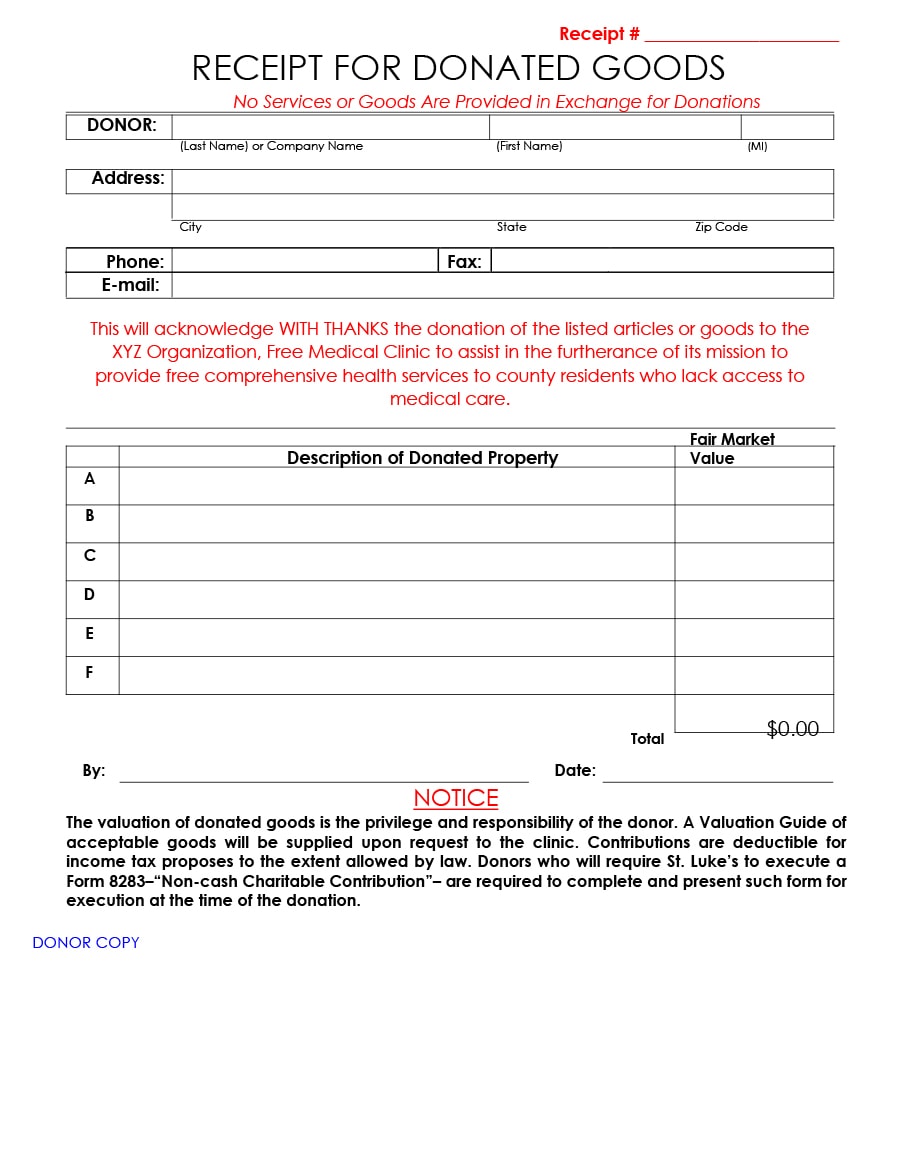

50 Receipt for Tax Deductible Donation Template

Free Sample Printable Donation Receipt Template Form

Pin on Receipt Templates

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Addictionary

Clothing Donation Worksheet for Taxes

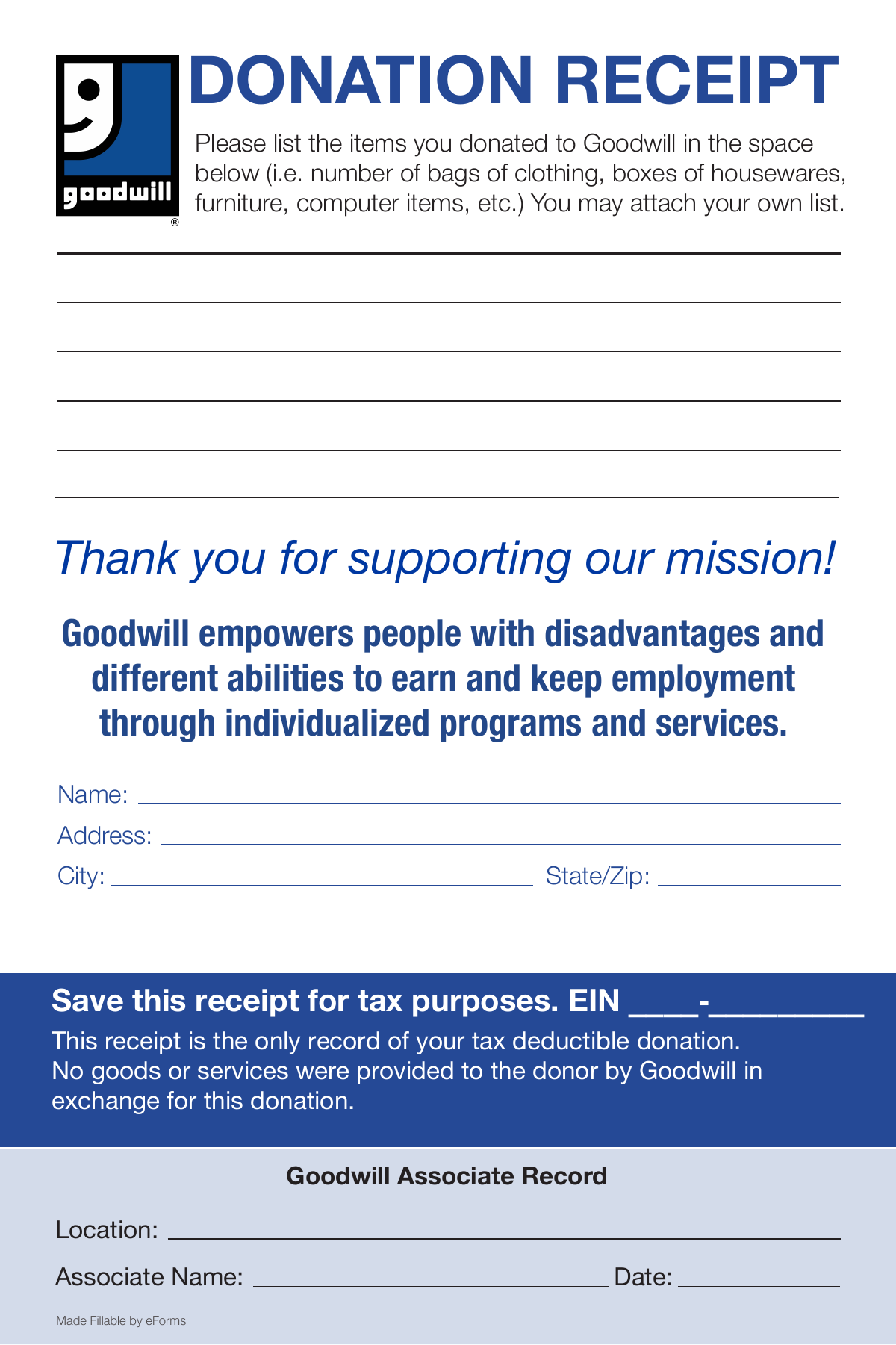

Free Goodwill Donation Receipt Template PDF eForms

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Related Post: