Tax Donation Receipt Template

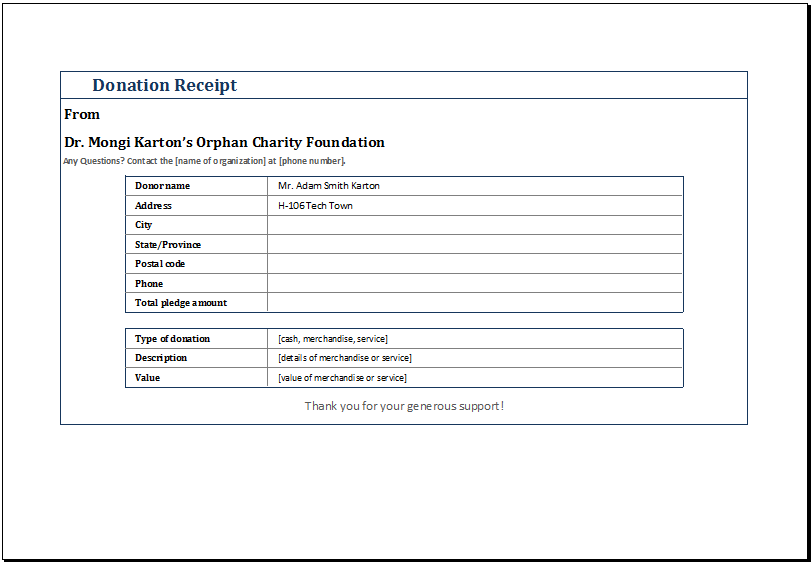

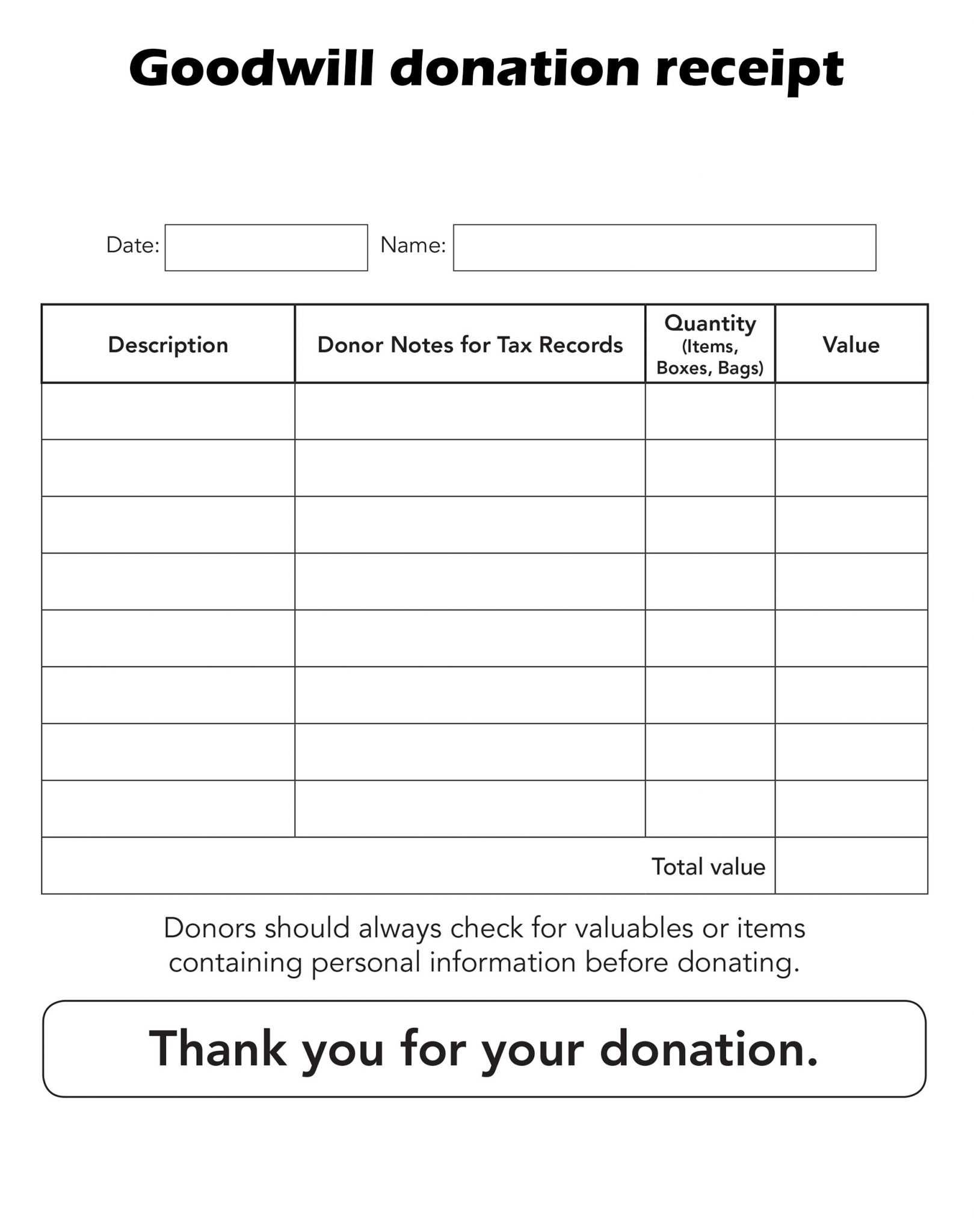

Tax Donation Receipt Template - These donation receipts are written records that. Donorbox tax receipts are highly editable and can be customized to. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web donation receipt templates let’s get started! A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web updated june 03, 2022. Web click the image below to take a look. Why do you need a donation receipt? Nonprofit donation receipts make donors happy and are. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Nonprofit donation receipts make donors happy and are. Web donation receipt templates let’s get started! Web click the image below to take a look. Donorbox tax receipts are highly editable and can be customized to. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Nonprofit donation receipts make donors happy and are. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Why do you need a donation receipt? Web click the image. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Donorbox tax receipts are highly. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Donorbox tax receipts are highly. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web depending on the donation type, a donor may need to obtain a receipt with the required information from. These donation receipts are written records that. Donorbox tax receipts are highly editable and can be customized to. Web click the image below to take a look. Web updated june 03, 2022. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web click the image below to take a look. Web donation receipt templates let’s get started! Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive. Web click the image below to take a look. Nonprofit donation receipts make donors happy and are. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on. These donation receipts are written records that. Donorbox tax receipts are highly. These donation receipts are written records that. Nonprofit donation receipts make donors happy and are. Web updated june 03, 2022. Why do you need a donation receipt? Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on. Why do you need a donation receipt? Web donation receipt templates let’s get started! Web updated june 03, 2022. Nonprofit donation receipts make donors happy and are. These donation receipts are written records that. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web depending on the donation type, a donor may need to obtain a receipt with the required information from the irs if they would like to receive a tax deduction on. Why do you need a donation receipt? Nonprofit donation receipts make donors happy and are. Web updated june 03, 2022. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web click the image below to take a look. Web donation receipt templates let’s get started! Donorbox tax receipts are highly editable and can be customized to.FREE 36+ Printable Receipt Forms in PDF MS Word

Big Brother/Big Sister Donation Receipt Template Sample GeneEvaroJr

6 Tax Donation Receipt Template SampleTemplatess SampleTemplatess

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Free Donation Receipt Template 501(c)(3) PDF Word eForms

Free Cash Donation Receipt PDF Word eForms

MS Excel Printable Donation Receipt Template Excel Templates

Donation Tax Receipt Template Database

FREE 9+ Donation Receipt Templates in Google Docs Google Sheets

Free Sample Printable Donation Receipt Template Form

Related Post: