Tax Provision Template

Tax Provision Template - Swot analysis/ market analysis/accounting plan. Web checklists for simplifying the tax provision process. Tax period / tax per 1.1.2021 prior years year refunds (+) 31.12.2021. A tax business plan template is a strategy for all aspects. Web part of a law that relates to payment of taxes on the activities covered by the law: Tax provisioning is a complex yet vital process that has a huge. Web what is a tax provision? A tax provision is the estimated amount of income tax that a company is legally expected to pay to the irs for the current. Web flowchart for tax provision preparation. You can export it in multiple formats like. Web tax provisioning simplified: You can export it in multiple formats like. Swot analysis/ market analysis/accounting plan. Web what is a tax provision? Web thomson reuters onesource tax provision software calculates corporate tax estimates in seconds, and lets you quickly review. The following videos provide examples for accounting for. Web companies may estimate the current income tax provision to issue financial statements before filing the related tax return. A tax provision is the estimated amount that your business is expected to pay in state and. Web tax provisioning simplified: Tax provisioning is a complex yet vital process that has a huge. Web examples of tax provision interim reporting. Last updated august 23, 2022. Web what is a tax provision? Web flowchart for tax provision preparation. Tax provisioning is a complex yet vital process that has a huge. Swot analysis/ market analysis/accounting plan. Tax period / tax per 1.1.2021 prior years year refunds (+) 31.12.2021. Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700 this implies that sandra co. Web provision for income tax calculation. Tax provisioning is a complex yet vital process that has a huge. Web what is a tax provision? A tax business plan template is a strategy for all aspects. The policyholder and each transferee and assignee of this policy, to the extent required by law, agree to provide. You can easily edit this template using creately. A tax provision is the estimated amount of income tax that a company is legally expected. Tax period / tax per 1.1.2021 prior years year refunds (+) 31.12.2021. Web examples of tax provision interim reporting. The following videos provide examples for accounting for. Web this tax provisioning template is based on a proven tax template, which has been developed by taxvibes and is used by. Web thomson reuters onesource tax provision software calculates corporate tax estimates. Web what is a tax provision? Web part of a law that relates to payment of taxes on the activities covered by the law: A tax provision is the estimated amount that your business is expected to pay in state and. The republicans succeeded in adding to the. Web provision for income tax entities are liable to pay income tax. Web what is a tax provision? Web this tax provisioning template is based on a proven tax template, which has been developed by taxvibes and is used by. The republicans succeeded in adding to the. Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial close. Web provision for income tax calculation. Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700 this implies that sandra co. The republicans succeeded in adding to the. A tax provision is the estimated amount of income tax that a company is legally expected to pay to the irs for the current. Web part of a law. Web checklists for simplifying the tax provision process. Tax provisioning is a complex yet vital process that has a huge. The policyholder and each transferee and assignee of this policy, to the extent required by law, agree to provide. Web thomson reuters onesource tax provision software calculates corporate tax estimates in seconds, and lets you quickly review. Web provision for. Web part of a law that relates to payment of taxes on the activities covered by the law: Web the template also provides formatting and structure for students to input their tax provision journal entries, the. A tax business plan template is a strategy for all aspects. Tax period / tax per 1.1.2021 prior years year refunds (+) 31.12.2021. Last updated august 23, 2022. Web flowchart for tax provision preparation. The following videos provide examples for accounting for. Web provision for income tax calculation. Swot analysis/ market analysis/accounting plan. Web examples of tax provision interim reporting. Web what is a tax provision? Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700 this implies that sandra co. Web companies may estimate the current income tax provision to issue financial statements before filing the related tax return. A tax provision is the estimated amount that your business is expected to pay in state and. Web this tax provisioning template is based on a proven tax template, which has been developed by taxvibes and is used by. A tax provision is the estimated amount of income tax that a company is legally expected to pay to the irs for the current. You can export it in multiple formats like. The policyholder and each transferee and assignee of this policy, to the extent required by law, agree to provide. Web thomson reuters onesource tax provision software calculates corporate tax estimates in seconds, and lets you quickly review. This is usually estimated by applying a fixed.tax provision DriverLayer Search Engine

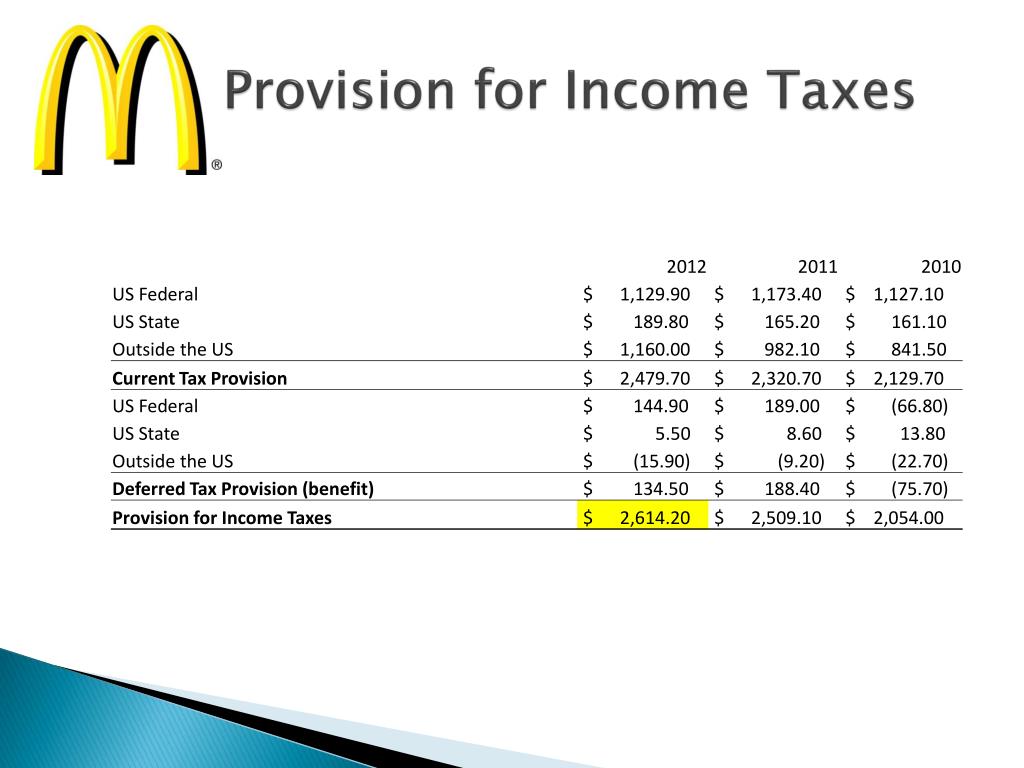

PPT Detailed Analysis of the Financial Reports McDonald’s PowerPoint

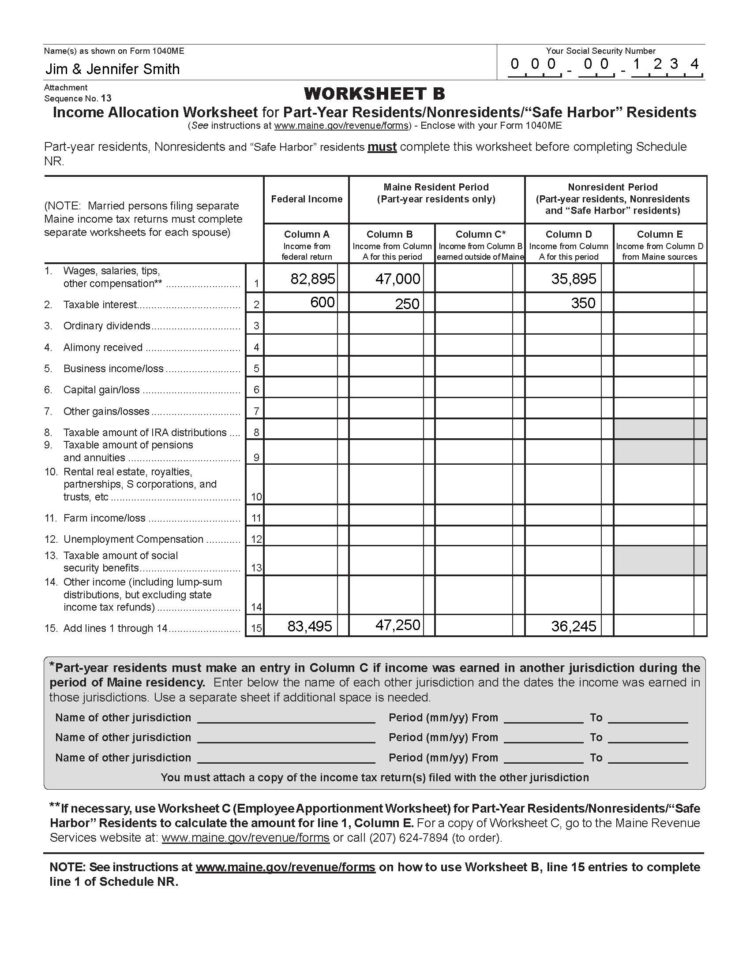

ITR related Provisions Overall Accounting

Rockwood Holdings, Inc. FORM 8K EX99.2 October 19, 2011

Tax Worksheet —

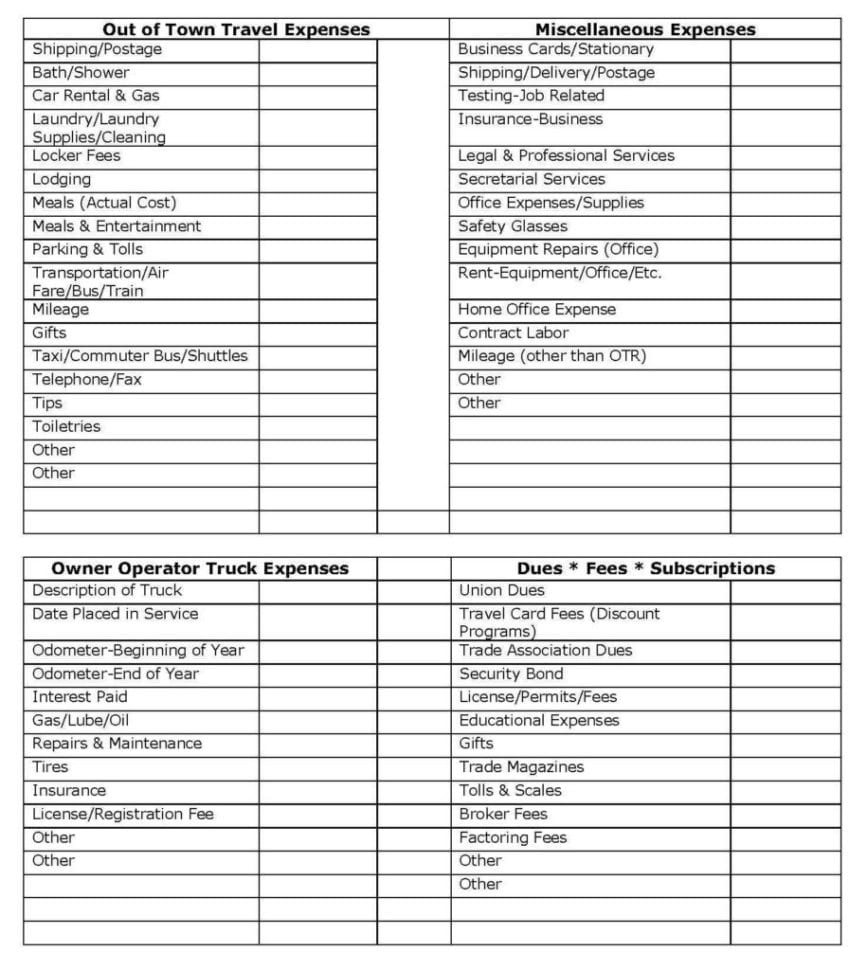

Tax Preparation Worksheet And Printables Non Cash —

tax provision DriverLayer Search Engine

tax provision DriverLayer Search Engine

Tax Provision Calculation Template Card Template

Journal Entry For Tax Provision

Related Post: